Advisory

Version 2.023: an upgrade or continued limbo?

29 Dec, 2022

The Christmas holiday season in many countries is marking the fact that a new year is just around the corner. It is time to reflect on what 2023 may have in store for us all and dwell on a very exciting December that leaves us with many things to ponder over the holidays.

As we strive to continuously improve the market intelligence we provide to customers around the globe, we are delighted to announce that we have partnered up with Drewry, one of the world’s leading transport and supply chain advisors, for more than five decades. In essence, this means the insight and analysis provided are co-created by Scan Global Logistics and Drewry, allowing for a neutral 360-degree view of the current and future market outlook.

And let’s just kick it off!

Ocean freight takes the headlines

Yet again, ocean freight rates tumbling from historic inflated levels have taken the headlines in recent weeks, which in turn has been a catalyst for a tsunami of theories on how 2023 will unfold.

With the sceptre of the Ukraine war waving above their heads, European consumers are also being squeezed by high energy prices. With no end to the conflict in sight and the prospect of the 2023 winter being worse in terms of security of energy supplies, this does not bode well for the medium-term demand outlook swinging the pendulum towards freight buyers firmly reminding ocean carriers that the last two years party is officially over.

Carriers unable or potentially unwilling to lower deployed capacity sufficiently fast find themselves chasing cargo again as vessels are heavily under-utilized. The billion-dollar question is now how the 2023 long-term contract season will play out vs current spot rate levels. For now, the obvious prediction is that long-term rates (more than 3 months validity) will end up at significantly lower levels than in 2022, but that does not answer the question if they will converge with current spot rate levels or not.

For now, the answer is no, with carriers standing firm that current spot rates are not a true reflection of the mid and long-term outlook, and this essentially means the waiting game is on.

With carriers aiming to boost their long-term rate negotiation stance, sporadic GRIs (General Rate Increase) are back, although unlikely to stick, and so are further blank sailings programs. The good news from a customer and freight forwarder perspective is that focus again is less on securing capacity and more so finding the right solutions balancing cost, service and quality.

2023 crystal ball view

Seaside terminal congestion is no longer propping up freight rates to the extent seen in previous years. Inflation is causing a ‘cost of living crisis’ among consumers globally. Combining these factors with the sudden drop in demand of up to 20% year-on-year has resulted in an even stronger reduction in spot rates on the main East-West head-haul markets out of Asia.

While trades ex Asia to Europe and US tend to get the most spotlight, it is not a ‘one size fits all’ development across trades, with Trans-Atlantic being a prime example of this. While rate levels on this trade have softened slightly, rates remain elevated compared to pre-Covid-19 with a significantly healthier supply and demand balance. This is namely due to the Asia trades historically being B2C driven (business to consumer). In contrast, Trans-Atlantic holds a significantly higher portion of B2B (business to business). We will deep-dive into this trade lane later in this advisory.

Sustainability measures are accelerating

IMO 2023 and the associated cost of it remain a dark horse in terms of rate level impact. Analysts across agree that it is not recommended that rate levels again fall to unsustainable levels for carriers (loss-giving) while also agreeing that the last two years of rate inflation have done no good for global trade either.

The growing importance of carriers' environmental performance, pursuing significant CO2 reductions on the back of newer and stricter legislation, will become a new battleground of competitive differentiation between carriers. More than 50% of the current order book is penned for non-conventional fuel types, and this development is essential and critical for the industry as a whole.

In China, we are entering the year of the rabbit, which amongst others, is a symbol of longevity, peace and prosperity. Consequently, a relevant new year’s resolution is that 2023 will be the year where shippers, forwarders and carriers find common ground with longevity for the industry as a whole in mind, bringing prosperity to all parties in the logistics eco-system. In more plain terms, abandoning pure short-term speculation and negotiating contracts with stability and balanced rate levels. This will allow for cost competitiveness for customers across the globe while allowing carriers to invest in new vessels and technology, reducing CO2 emissions.

Something is in the air

On the airfreight side, some big news is just in, with China officially changing Covid-19 policy and now allowing entry into China basis of a negative PCR test and, for the first time in 3 years, no quarantine requirement of any sort. The logical implication and consequence of this should be a steady increase in travel to and from China, leading to a rebound in passenger flights and boosting belly-hold capacity.

On the flip side of this coin is an imminent fear of staff shortage in airports and cargo-handling facilities due to rapidly rising infection levels. It brings back the congestion ghost that has tormented the industry for the last years. This will also be a factor for ocean freight, although overall too early to speculate on the actual impact of this.

As importantly, increased demand is expected to follow as well, considering the simple fact that an increase in business travel equals more trade. Overseas companies in Europe and US will once again be able to do business in China in the way they have been accustomed to and thus regain confidence in China being the no. 1 ‘factory of the world’.

Overall, SGL's view of the current market climate is that the macro eco-system is in a state of shock. Consumers across the western world, on paper, have historically high savings. However, fear and uncertainty drive consumers to think twice before spending money, prioritizing necessary purchases such as food and utilities and less the typical products sourced in Asia such as textiles, garden furniture, electronics etc.

Combined with historically high inventory levels, there is a need for a ‘correction’ period, but with underlying stable economies, consumers are expected to start spending again during 2023.

If anything, the last two years taught us that “normal” does not exist and that development can change overnight – again.

For more in-depth analysis, please fasten your seatbelt as we walk you through some of the specific impacts and developments within air, ocean, and rail freight.

Let's get specific for each transport mode:

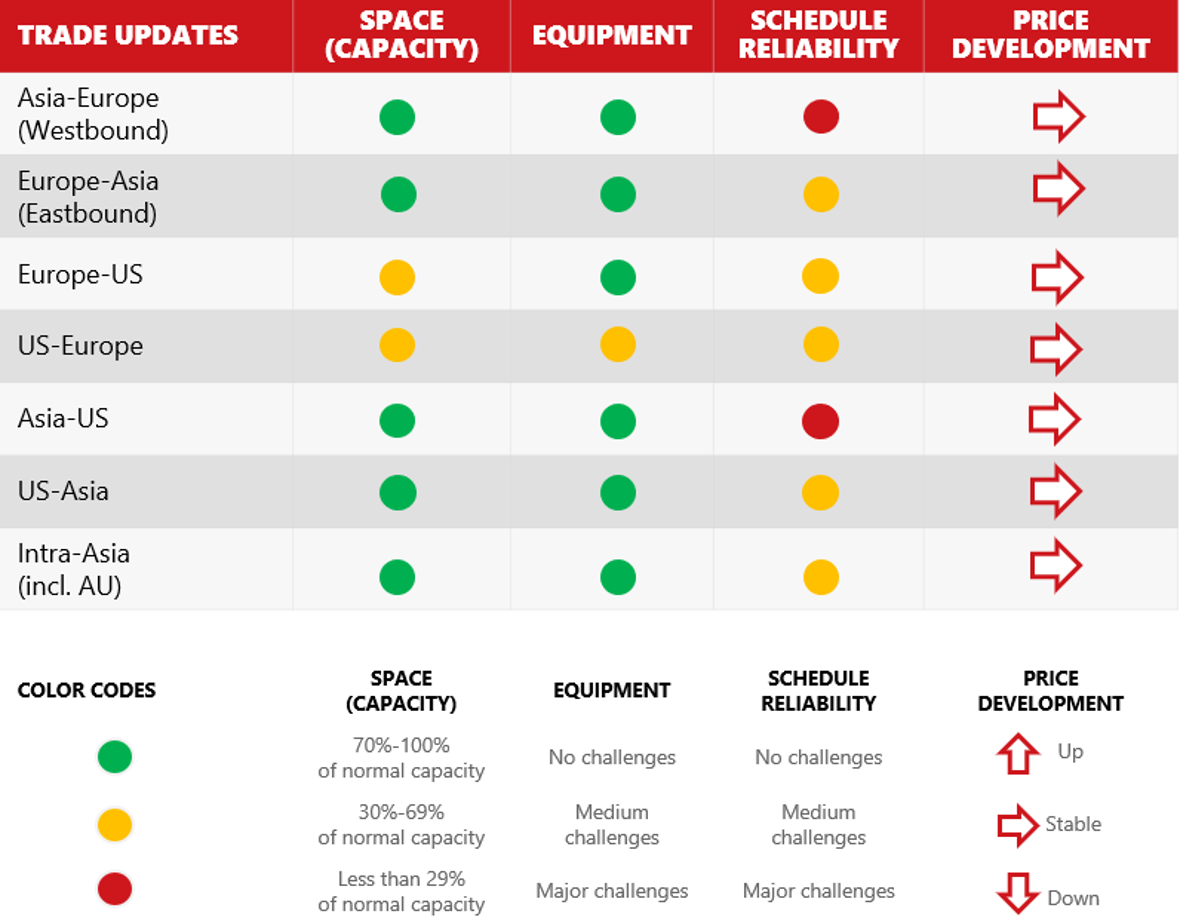

Airfreight market update week 52

OCEAN FREIGHT

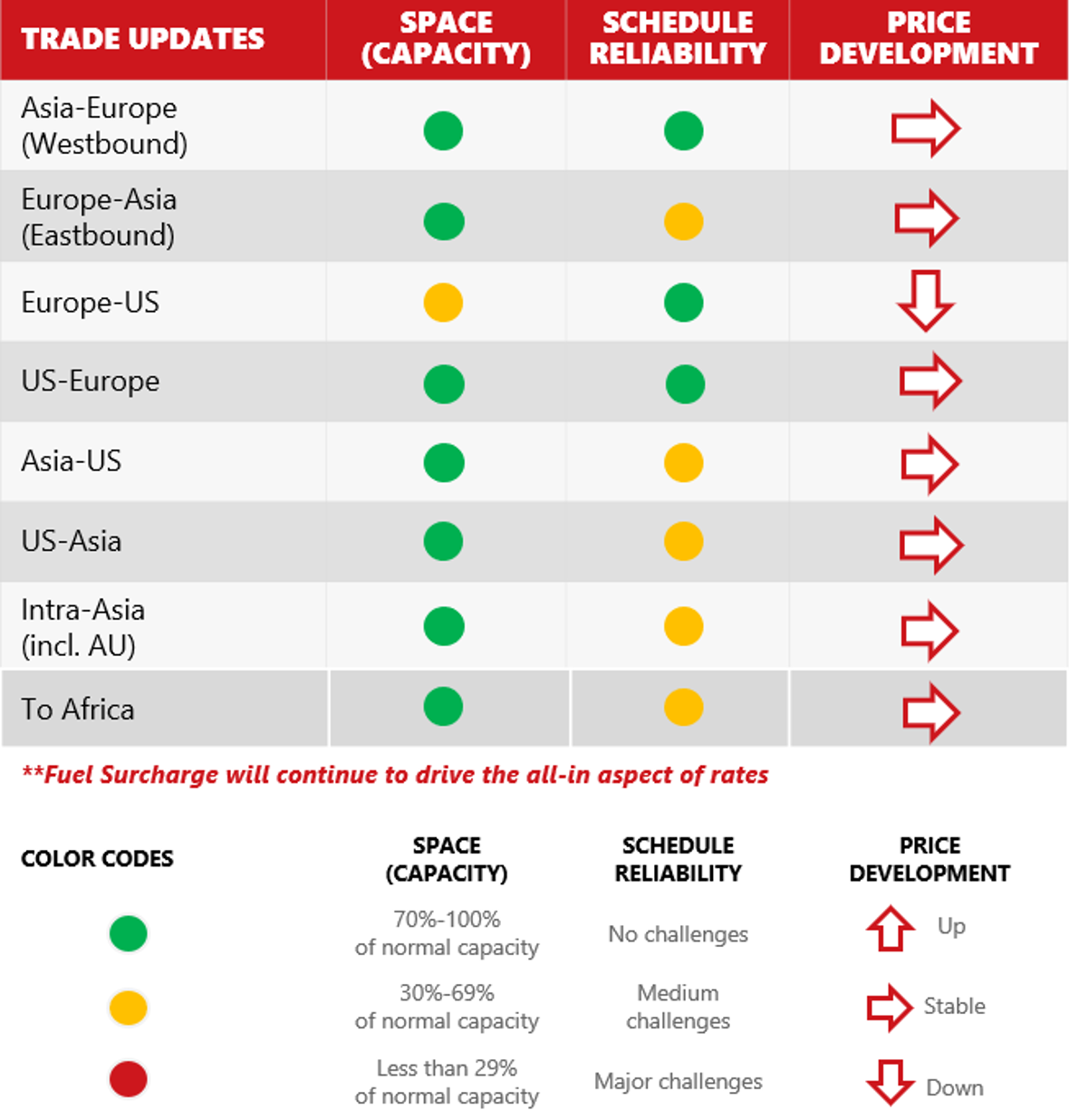

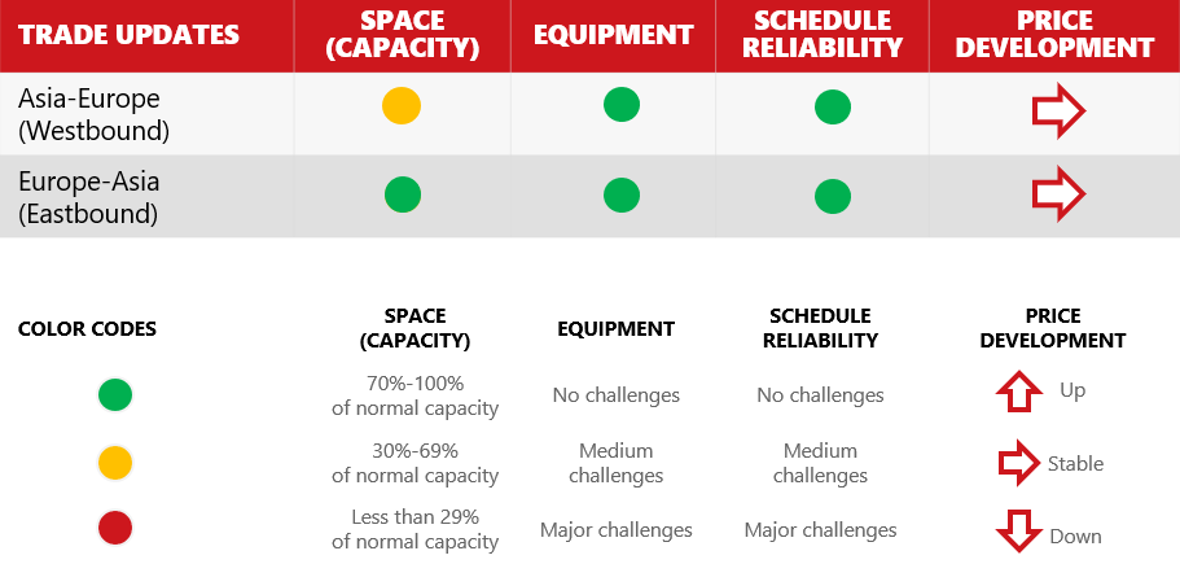

The drop in spot freight rates accelerated during November and the first weeks of December on all major East-West head-haul trades except for the Transatlantic Westbound trade. On the Trans-Atlantic Westbound, trade rates peaked in early November and have since softened slightly to the tune of $50/TEU per week.

Market sentiment has deteriorated on the Asia outbound routes to North America and North-western Europe. This is mainly due to high inflation levels, which have reduced demand in key consumer areas, and Covid-19 lockdowns in China, which hindered manufacturing goods and cargo transport to the ports. Although in recent weeks, the lockdown measures imposed by the Chinese government have eased, it will take several weeks before factories sort out their inbound supply of raw materials and start operating at higher utilization levels.

Spot rates plateauing

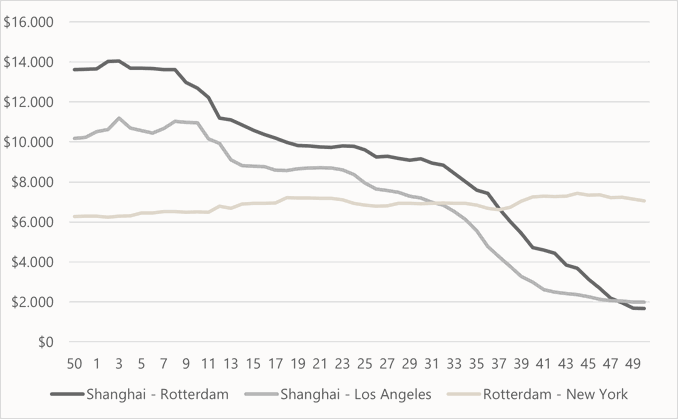

In the third week of December, spot rates on the Trans-Pacific Eastbound and Asia-Europe Westbound trades have already shed about 80% from their peak levels, albeit now appear to be stabilizing.

As highlighted in the intro, it is imperative to differentiate between spot and long-term rates. While spot rates will likely continue along a volatile trajectory with significant week-on-week fluctuations depending on how full vessels are, long-term rates are expected to plateau at a higher level than current spot rates.

Plateauing of spot rates is visible below, and the distinct difference in the Trans-Atlantic trade.

Source: World Container Index assessed by Drewry

Week 50 was the first week since May where SCFI (Shanghai Freight Index) to Europe base ports actually increased from USD 2,094/FFE to USD 2,100/FFE and, in the subsequent week, stabilized at USD 2,098/FFE.

Rate plateauing also marks the best-educated guess for the coming months. This represents a win-win for both freight buyers and ocean carriers. Freight buyers are taking home the stakes and banking significant savings, and conversely, carriers are stopping the downward spiral just in time for the 2023 contract negotiation season and at levels that are still respectable in a historical light.

On a reflective (positive) note, any notion and speculation on carrier collusion seem unfounded. Contrary to what Drewry expected after the quiet summer peak season, carriers have proven to be unable to proactively reduce capacity and counter the freight rate collapse witnessed in the last quarter. Talk of market concentration and the formation of ‘dangerously powerful’ oligopolistic markets suddenly seems to be history when looking at this recent price evolution. In fact, given that the carriers’ cost base has increased substantially compared to three years ago, carriers find themselves painfully close to loss-making territory again on some of the key trades ex Asia.

On the landside, the trend of easing congestion continues, however, with shifting hot spots, especially in the US, where East Coast ports are now hit worse than West Coast ports. At the time of writing this, the winter storm Elliot, one of the most deadly winter storms in history, has eased in the US. Still, the after-effects are expected to be grave and cause significant delays in deliveries and pick-up from terminals and rail ramps.

In Europe, congestion levels are improving across all ports as a logical consequence of less pressure on the landside pain points. Rotterdam remains slightly impacted by high yard density and hinterland connection delays of up to one week.

Blanking programs in full motion

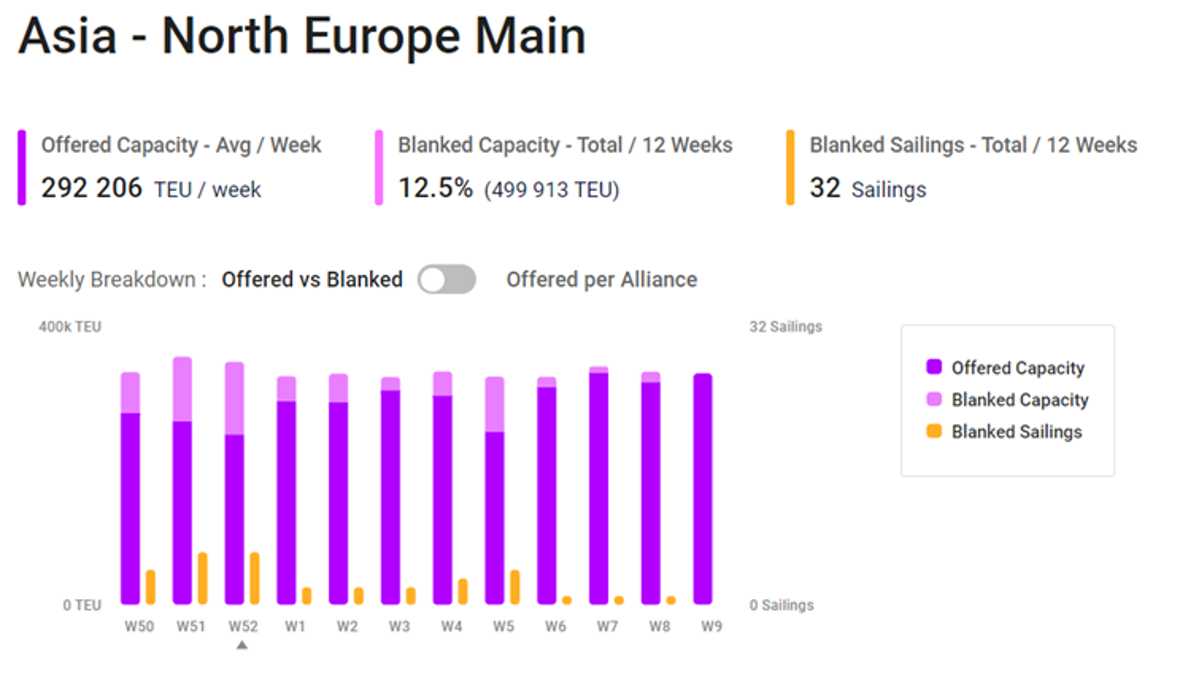

Should one have forgotten about blankings of specific voyages, then they are very much ever-present still. Carriers continue to turn to blankings as the most effective tool for sustaining freight rate levels, with this pointing to some form of continued unstability for shippers across the globe.

As can be seen from the below graph from Xeneta, a total of 499.913 available TEU capacity over a 12 weeks period was impacted by blankings corresponding to a blanking rate of 12,5 % on the Asia-North Europe trade.

It is a similar picture on other key trades, with Asia-Mediterranean seeing a blanking rate of 14,1 %, Asia-US 10 % and 10,4 % for West and East Coast respectively and finally, Trans-Atlantic with 9,1 %.

Source: Xeneta

Transatlantic Westbound deep-dive

Contrary to the demand collapse on Asia outbound ocean trades, on the Transatlantic Westbound trade, year-to-date volumes in October were only 1.2% lower than last year’s volumes. As highlighted in the introduction, this is very much owed to Trans-Atlantic trade being less consumer-driven vis-à-vis trades ex Asia.

Digging a little deeper, a notable trend is that shippers are increasingly diversifying their sourcing locations in Asia. It is also known as the ‘China +1’ sourcing strategy, resulting in cargo origins shifting Westwards to South and Southeast Asia, making the Suez routing to the US East Coast more attractive.

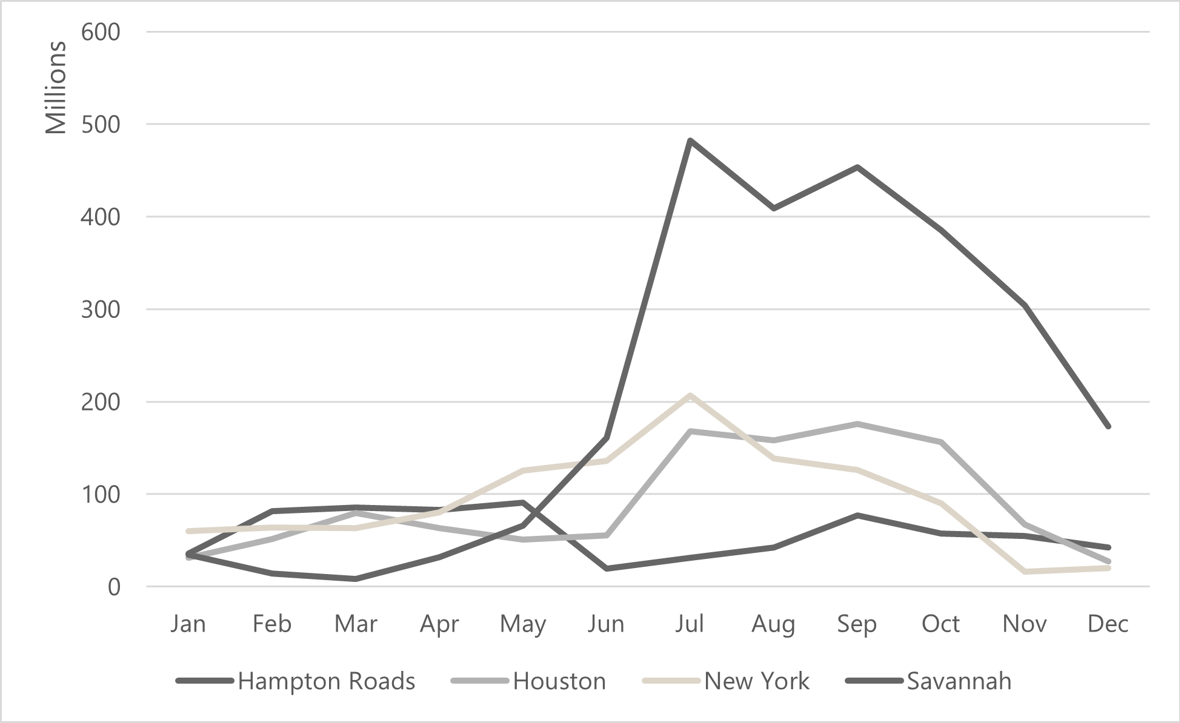

Inasmuch as overall congestion levels are more ‘healthy’ than seen in a long time, issues persist to be ever-present. The congestion at US East Coast ports started in Norfolk and quickly spread to New York and later to Savannah, which got completely overwhelmed in July. Since September, though, the situation in Savannah has rapidly improved, and so has the situation in other East Coast ports.

Vessel congestion, measured in TEU-days, at key US East Coast ports

Source: Drewry Maritime Research

Trans-Atlantic rate levels draw in additional capacity

During the first 10 months of this year, some 8.7% extra capacity was made available on the Transatlantic trade (effective capacity, netted of blank sailings) as carriers increasingly wanted to benefit from high rate levels. Freight rates remained high even though vessel load factors fell from an average of 87% during the first 10 months of 2021 down to 79% during the same period of 2022.

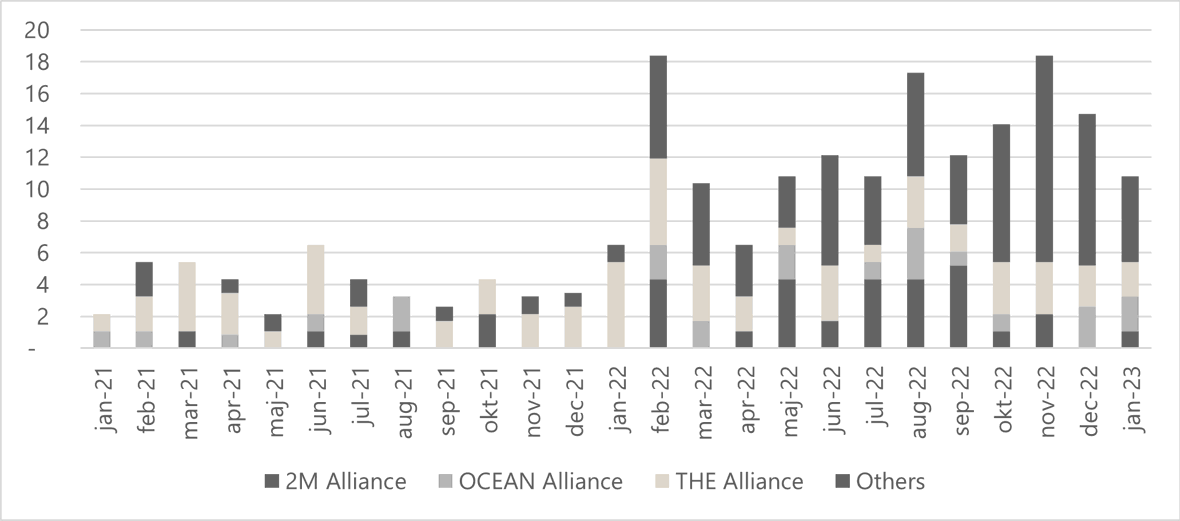

Carriers ‘blanked’ even more sailings in an attempt to sustain high load factors. While in 2021, it was mostly the Alliance blanking sailings, in 2022, the non-Alliance services were the prime target for blankings. Blank sailings appear to have peaked in November, and service reliability in terms of vessel departures is likely to improve in the coming months.

Monthly blank sailings by Alliance (N Europe-N America)

Source: Drewry Maritime Research

In the coming weeks, more capacity will be added to this trade: Ellerman City Liners will commence a Transatlantic service using vessels from its former China-UK express service, while members of Ocean Alliance are gradually replacing smaller ships with 14,000 TEU vessels.

In the context of slumping demand, limited blank sailings, congestion easing and freight rates starting to soften, there is a growing consensus that the Transatlantic will also join the path of rate level moderation during 2023. However, it is not expected to happen at the same pace nor to the same extent as seen in Asia trades.

AIRFREIGHT

The peak that never happened is a fair description of the current temperature of the airfreight market.

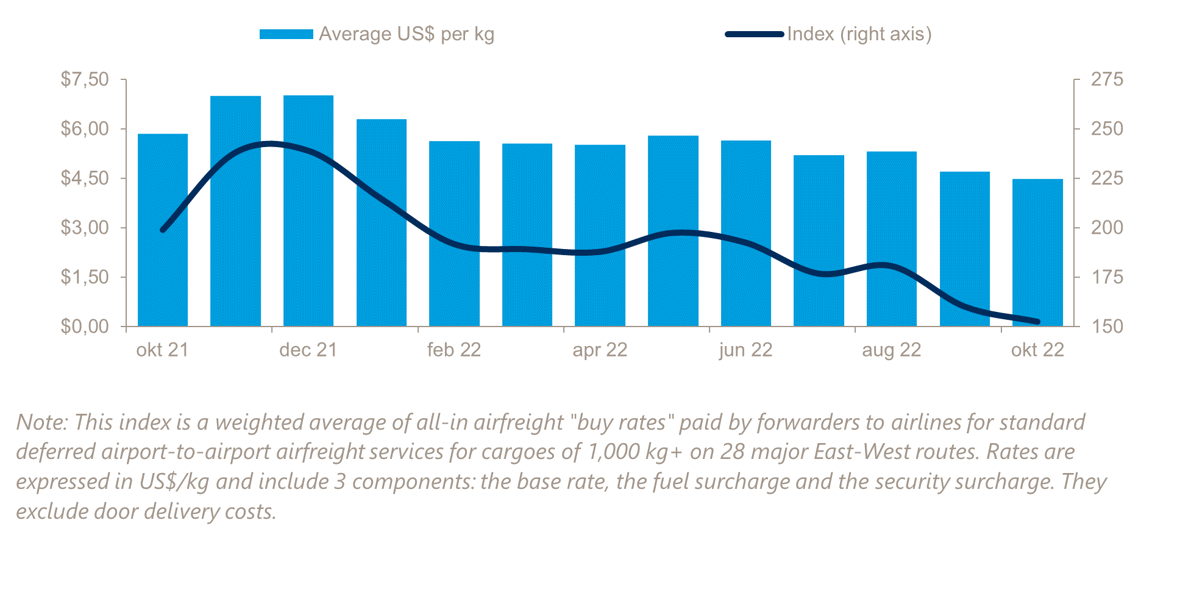

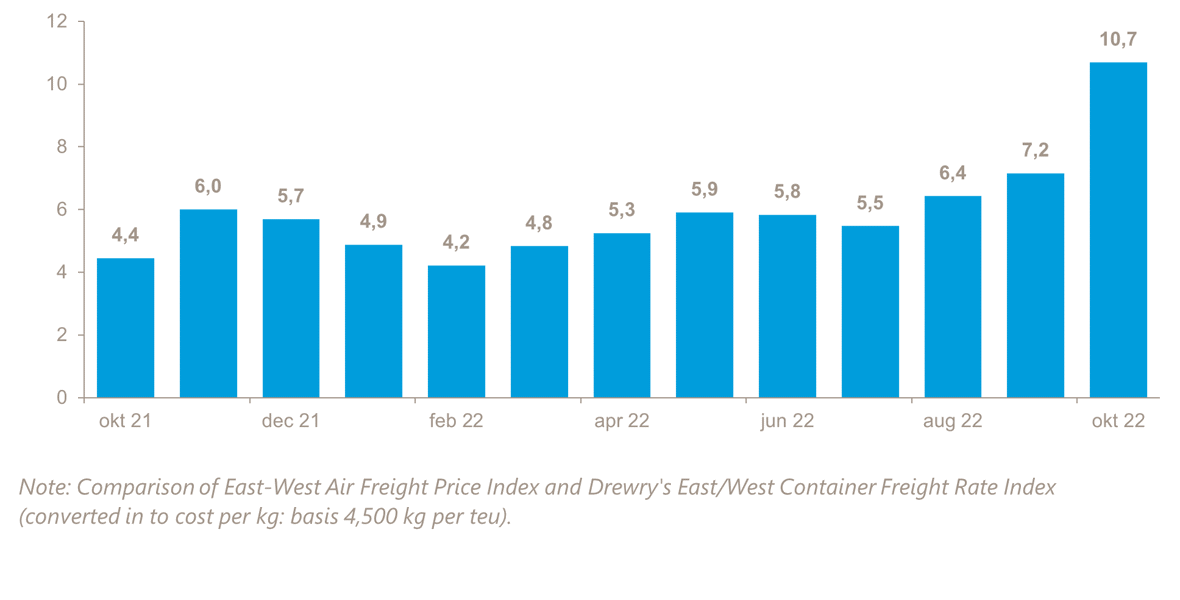

This said, although airfreight rate levels have also been softening in recent months, they do not mirror the dramatic tumble in ocean freight levels. The October Drewry East-West Airfreight Price Index stood about 23% below last year’s level. However, the Drewry East-West Airfreight Price Multiplier has increased to 10.7 again, indicating the relative cost of air to the ocean has doubled since summer.

Drewry East-West Airfreight Price Index [May 2012=100]

Source: Drewry Maritime Research

Drewry East-West Airfreight Price Multiplier

Source: Drewry Maritime Research

Airfreight rates dropped after the sector lost momentum in September in terms of demand and capacity. Owing to headwinds and key economic indicators pointing to tepid demand ahead, forecasts have become more pessimistic, pointing to further softness in pricing.

With airfreight being the most expensive transport mode, many companies have taken extra measures to reduce airfreight volumes as a consequence of experiencing dramatic cost increases in other parts of their business especially related to energy prices.

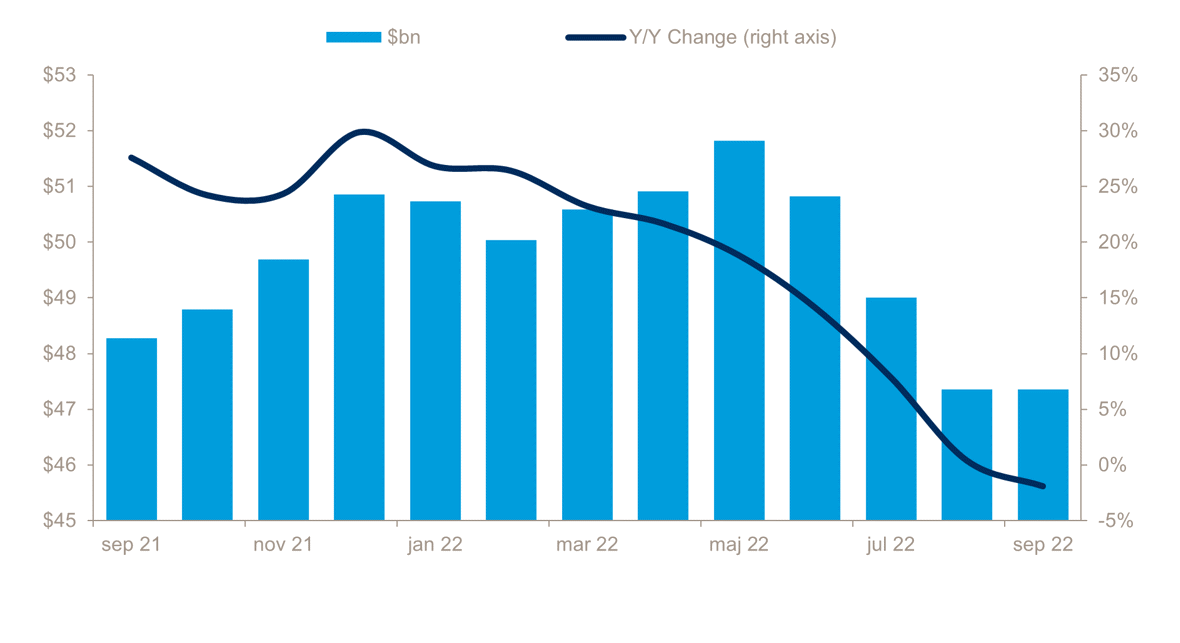

At $47.4 billion, September global semiconductor sales, a key barometer and indicator for airfreight demand, showed the first year-on-year drop since January 2020, trailing September 2021 volume by 1.9%. Sales growth has slowed since last December, and producer forecasts indicate further contraction in demand.

Worldwide Semiconductor Sales, 3-month rolling average, % change y-o-y

Source: Semiconductor Industry Association

The Covid-19 policy change in China is expected to have a major impact on the airfreight industry, both in terms of additional capacity coming into the market, but as well a corresponding increase in airfreight demand.

Air cargo association Tiaca commented recently on the 2023 outlook by saying ‘another tough 12 months for air cargo demand, but also outlined positives for the industry’ noting that ‘structurally the industry is in a good place and towards the second half of 2023 we could see demand picking up compared to this year’.

Tiaca further noted that “current retail inventory levels are high, but when consumer spending resumes this should come down” and rounded off by stating that “the relaxation of Covid-19 policy in China should help production levels improve”.*

The capacity situation for the Trans-Atlantic trade is somewhat different from Asia trade lanes. Capacity has decreased as a result of the winter schedule commencing (in November), balancing out the minor demand decrease. Due to this, Trans-Atlantic remains more stable. Looking ahead, the next major impact on this trade will come when summer schedules commence in April, with this boosting overall capacity.

A very clear trend resulting from the softening rate levels and improved capacity level is a move from pure spot procurement to freight buyers starting to contract rates with 3 and 6 months validity.

Overall, we expect the coming months to be stable with a slight uptick in demand ahead of Chinese New Year, but not to an extent where there will be pressure on available capacity.

*https://www.aircargonews.net/airlines/tiaca-positive-for-air-cargo-in-2023-despite-tough-outlook/

RAIL FREIGHT

Overall, rail freight services and performance have been stable, with minor disruptions in recent weeks and months.

Westbound

Chinese New Year (CNY) is coming up impacting available capacity. There are available options, however, trucking capacity will be limited with many drivers returning home for the holidays. As always, it is important to plan and book in advance.

The swift relaxation of China’s Covid-19 policy may pose a further threat to the availability of drivers. Covid-19 is not expected to affect the rail operation directly. Still, if there are many delays from shippers due to a lack of human resources, some departures may be affected by minor delays if it proves necessary to consolidate trains.

Rail freight rate levels have seen a stagnation and not followed drops relative to the ocean freight market. There is no indication that China Railways and the rail operators are willing to drop rates below an actual cost level to attract volumes before the Chinese New Year. The capacity will simply be reduced to fit the demand.

We have been running tests on a new Rail Express service from China to Germany for the past months, and it has proven to maintain an average transit time of 14 days from station to station compared to the standard average of 23 days.

Eastbound

Rail transport from Europe to China remains stable with a relatively constant rate level and stable transit time performance.

Want the whole advisory in PDF format? Download it here