On behalf of Scan Global Logistics

Global COO & CCO

Advisory

13 Feb, 2024

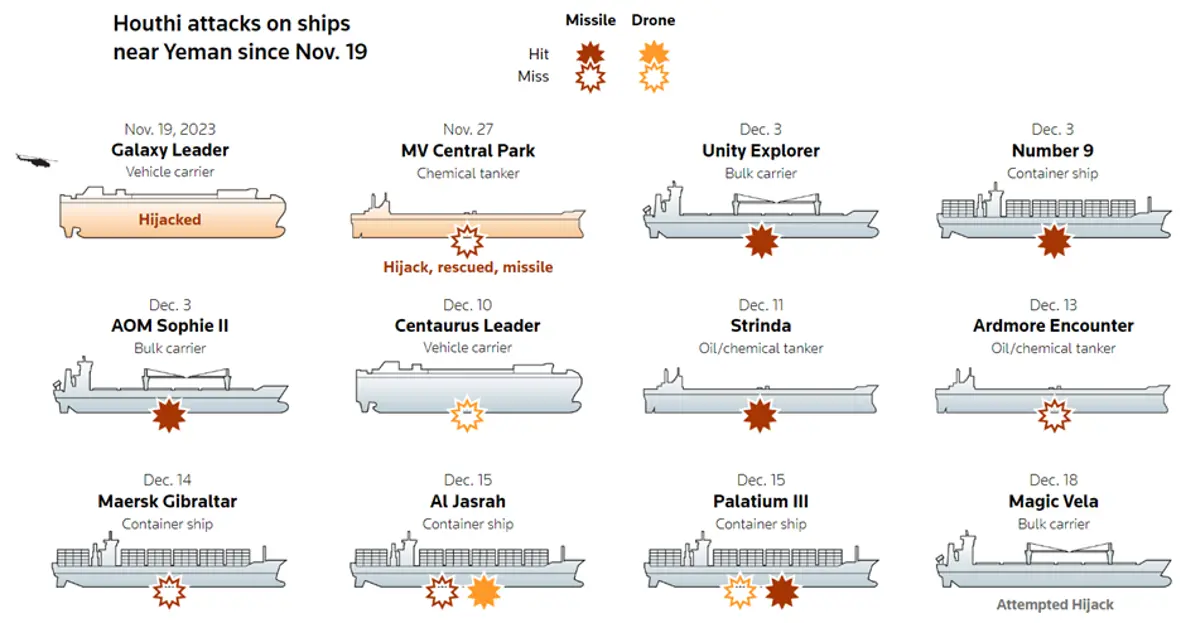

The first attack was registered on 19 November, when Houthi rebels landed a helicopter on the Galaxy Leader as it was transiting the Red Sea. The rebels managed to seize control of the vessel and redirected it to Hodeidah port in Yemen, where both crew and vessel are still being held.

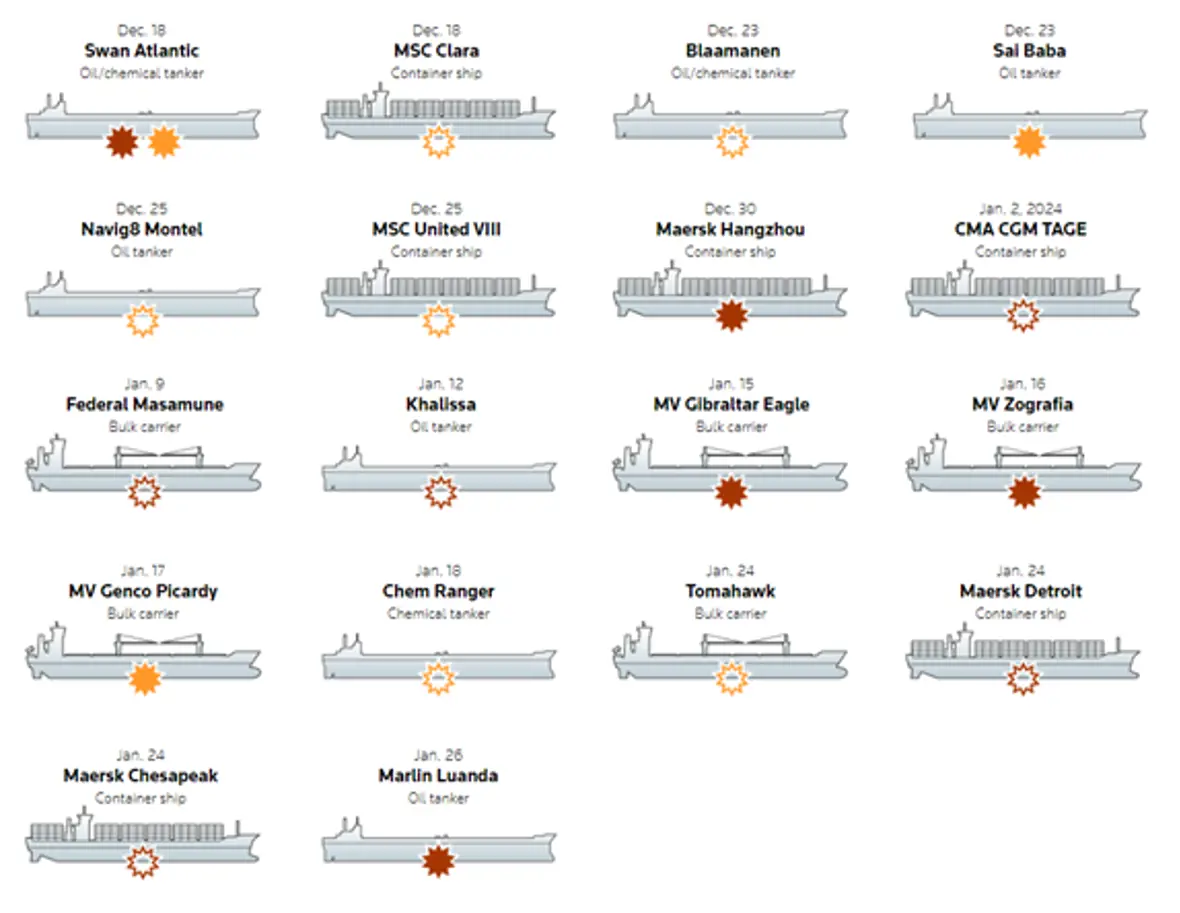

More than 35 commercial vessels have been attacked since then. In recent weeks, attacks have accelerated in numbers, with Houthi rebels responding to US and UK-led attacks on Houthi military infrastructure.

Below is an overview by Reuters in an article published on 2 February that provides first-hand insight into the many attacks and their nature. It is widely considered that without a US-led invasion of Houthi-controlled areas in Yemen or a political resolution, it will remain challenging to resolve the conflict. Houthi rebels deploy very simple methods, for example, utilising drones, when launching attacks, making it very difficult to prevent attacks entirely.

Source:Reuters

Add to this that the Bab al-Mandab strait, where most attacks have taken place, is very narrow, spanning only 26 kilometres at its most narrow point, from Ras Menheli in Yemen to Ras Siyyan in Djibouti.[1] This allows Houthi rebels to quickly retreat to shore following attacks, leaving Allied navy vessels to engage mainly in preventive measures.

Source:Reuters

Geo-political stand-off between USA and Iran

Houthi rebels, who control the vast part of populated areas in Yemen, have woved to continue attacks until Israel halts its siege of Gaza. Israel, in turn, maintains that their offensive in Gaza will continue until Hamas has released all hostages seized in the 7 October attack on Israel, with the end objective being a complete disarmament of Hamas.

It´s also clear that the current situation has a broader narrative, with leading analysts echoing that Iran repeatedly supports and encourages Houthi rebels to continue attacks. This, in turn, also means that the U.S. and allied countries have been forced to show restraint when conducting military operations against the Houthis to avoid a full-scale conflict in the Middle East.

Source:Reuters

Industry players adapt to a new normal

Unlike other major container carriers, CMA-CGM has, in recent weeks and months, persisted in transiting through the Red Sea; however, following the rapid increase in attacks, including attacks where CMA CGM vessels were targeted, the French-based carrier has now officially confirmed that it will no longer transit through the Red Sea.

This, for now, fully cements the notion that the industry is looking into a mid-term scenario where East-West transit times will be affected by the inability to utilise the Suez Canal and, instead, is forced to transit via the Cape of Good Hope.

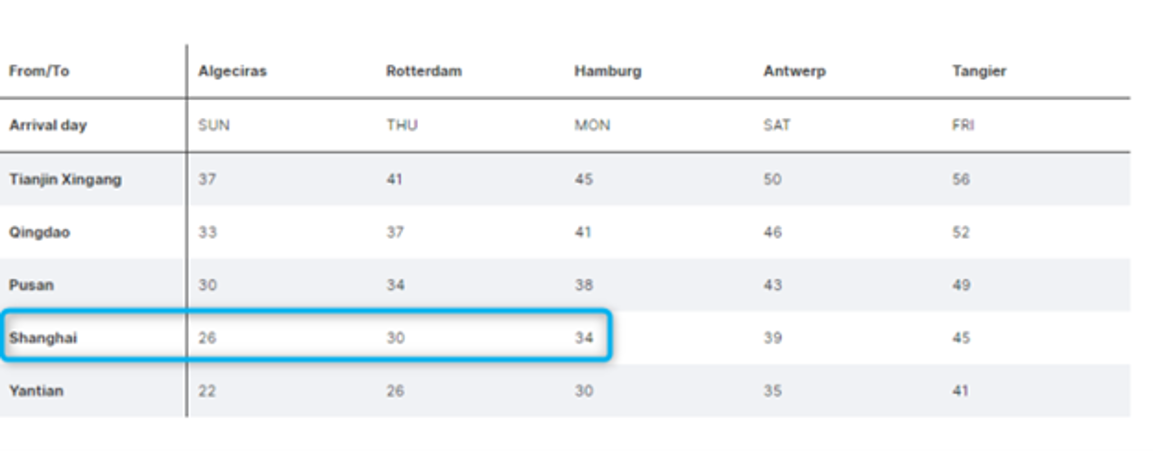

Accordingly, most carriers have now adjusted schedules 100% to fully reflect the Cape of Good routing, which also allows for a more precise analysis of the exact additional transit time compared to transit times before the conflict broke out.

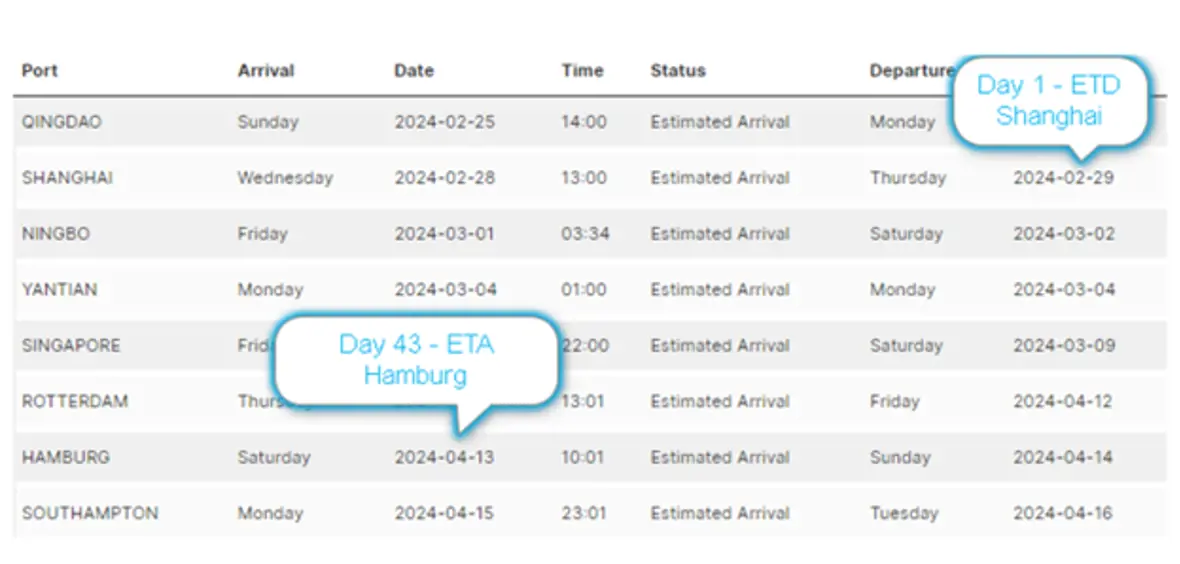

As one example, in the case of Hapag Lloyd, the transit time prior to the Red Sea conflict on the FE4 service from Shanghai to Hamburg was 34 days.[2]

As seen below, the revised and newly published schedule on the same service now shows 44 days and, accordingly, an extended lead time of nine days due to routing via the Cape of Good Hope.

We, therefore, also wish to provide updated guidance on the extended lead times to be incorporated into your lead-time planning on Asia-Europe. Based on the above, we recommend adding up 8-10 days on the Asia-Europe trade and not, as earlier advised, 10-14 days.

Maersk and Hapag Lloyd's Q4 results published, telling the story of two different worlds

Maersk shares took a nose-dive of more than -15% following its published Q4 results on 8 February. This development came after Hapag Lloyd shares took a similar hit, to the tune of -10% some 10 days earlier. In both cases, owed to Q4 results raising eyebrows on the sustainability of rate levels mid and long-term.

Maersk and Hapag Lloyd, respectively, the 2nd and 5th largest container carriers in the world, both reported operating losses in Q4, marking a brutal return to reality, following the earning party years of 2021 and not least 2022.

Maersk reported a net loss of USD 442 million in Q4 2023, with its container line division reporting an operational loss of USD 920 million, dragged down by a collapse in ocean freight rates.[3]

As expected, guidance for Q1 2024 is significantly more positive, with Maersk CEO Vincent Clerc stating that the Red Sea crisis and corresponding increase in rate levels would boost earnings.

It is, though, not every day you hear a CEO purposely painting a very dark picture for the long-term despite the boost in Q1 2024 earnings. Vincent Clerk stressed that this is ‘not a bonanza like the COVID boom’ and went on to comment that ‘it is just a matter of time’ before the threat of overcapacity from the vast number of newbuild deliveries overcome the impact of Red Sea disruption, concluding ‘I don’t know how long we can hang on to the revenues we are getting today.’[4]

Further comments from Vincent Clerc exemplified the story of two world orders: ‘In Q1 we will over-recover, compared with the straight cost of the transport…this will cushion earnings in the first quarter, but over time this is pushing inflation in our costs that will take some time to work out of the system.[5]

A glimpse into the drivers of carrier earnings

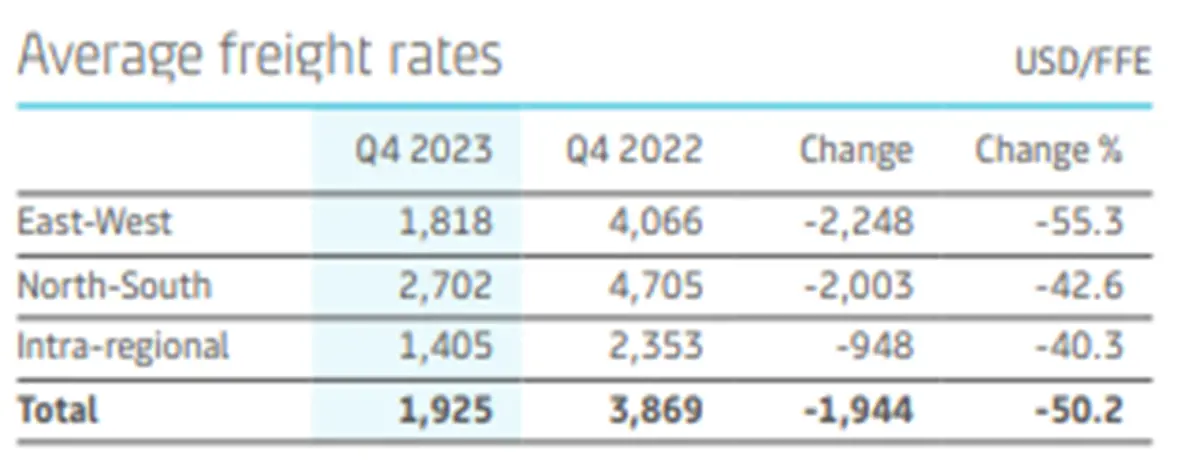

Maersk Q4 2023 revenues in its container division dropped a whopping 47% year-on-year, and this dramatic decrease despite an 11% increase in volumes. It was also worth noting that approximately 30% of Maersk volumes are exposed to the so-called spot market, providing some hope from Maersk that it will benefit from this in the coming period. Average freight rates dropped 50% (55% on East-West trades) to USD 962/TEU.

Maersk's Q4 report also provided a rare glimpse into earnings and the primary drivers behind them. Traditionally, a golden rule across container carriers has been that a round-trip on Asia-Europe-Asia should yield a minimum of USD 2000/FFE to deliver a profitable bottom line.

This golden rule still seems to be just about right, considering the operational losses reported by Maersk in Q4 2023 and the fact that the average freight rate on East-West was reported to be USD 1818/FFE

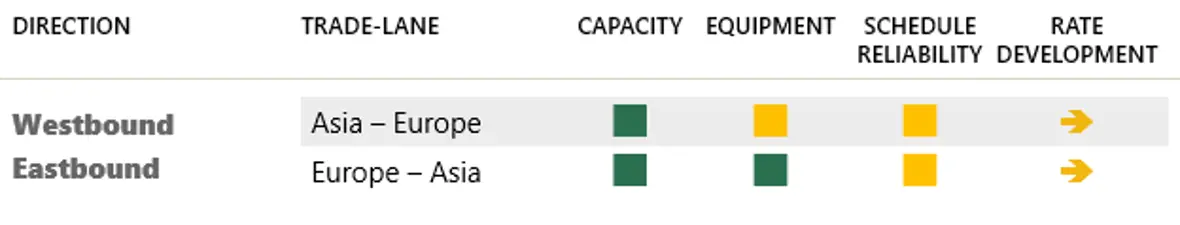

It´s important to highlight that East-West, as seen below, is the combined revenue of the average freight rate on both imports and exports between Asia and Europe.

Source:Maersk.com

Rate levels decide the game for Maersk, not volumes

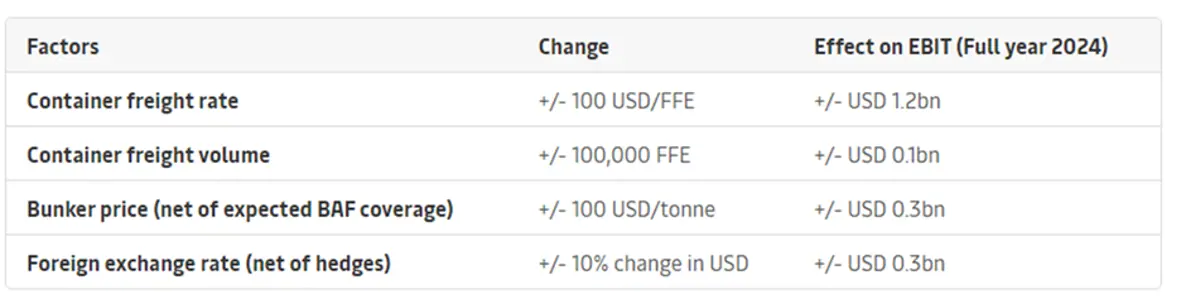

Another interesting number published in the Maersk Q4 report was the impact of fluctuation in freight rates on earnings. For every +/- 100 USD FFE increase/decrease, the impact on bottom-line earnings in the case of Maersk is USD +/- 1.2 billion.

Conversely, the impact of volume growth is much less, as seen below. A volume increase/decrease of 100,000 FFE only has a bottom-line impact of USD +/- 0.1 billion.

Source:Maersk.com

These numbers again confirm the immense implication of rate level fluctuations on carrier earnings and the thin line between a profit and loss-making rate environment.

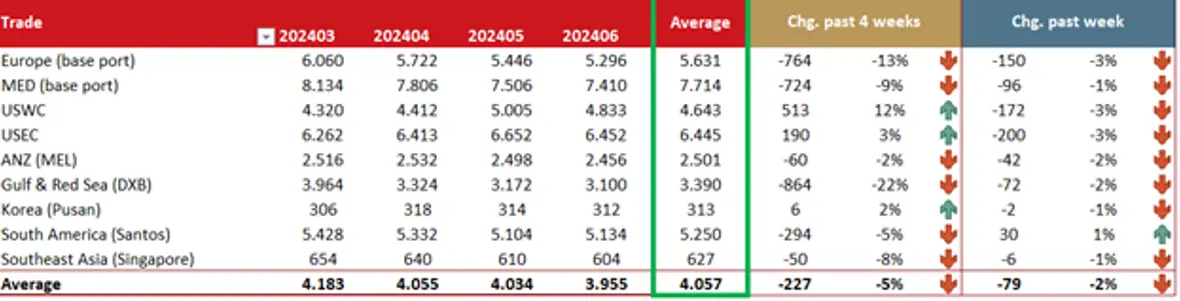

Rate level limbo dance continues as we head into Lunar New Year period

Zooming in on the short-term rate development, fresh SCFI numbers published on 9 February, contrary to what most expected, only showed a modest decrease of USD 150/FFE on the Shanghai to North-Europe trade.

This development is likely driven by the typical volume surge ahead of the full close-down of factories in China as the Lunar New Year festivities commence.

A similar modest trend was apparent on other trades, such as US East and West Coast, with rate levels dropping USD 100/FFE and USD 172/FFE.

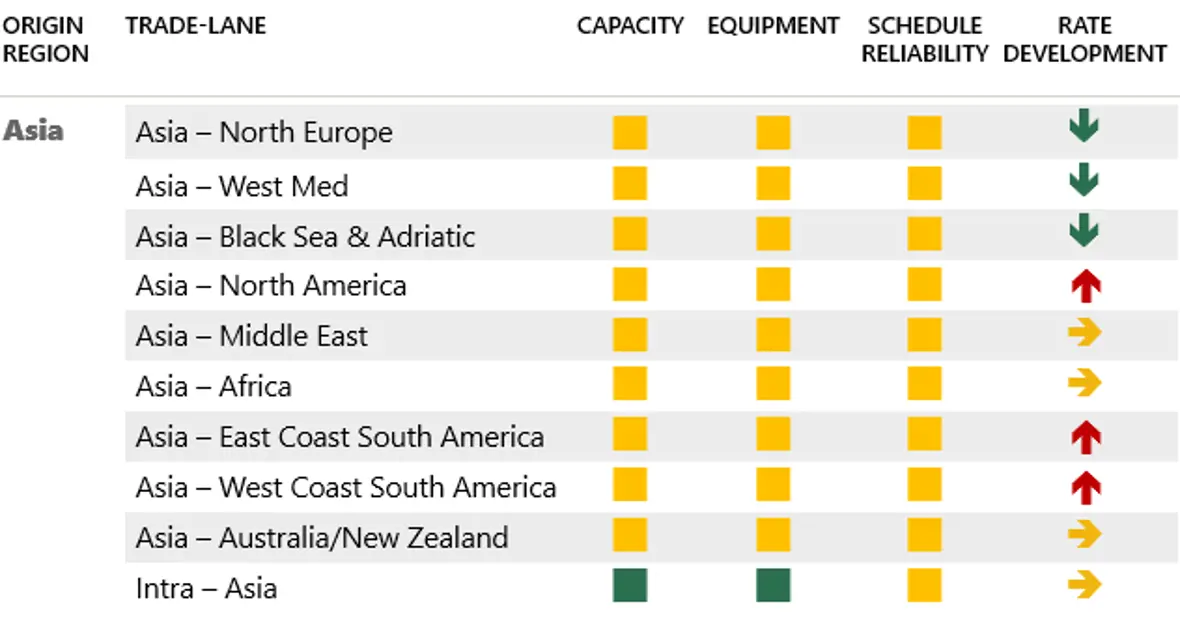

All in all, rate levels remain elevated compared to Q3 and Q4 2023, and our projection remains that throughout the first half of 2024, we will see a soft landing between current rate levels and Q4 2023 rate levels.

The market has sufficient capacity overall, and a more prudent long-term approach from the carrier side also seems clear compared to the pandemic years. On the other hand, it is widely considered that it is not sustainable for carriers to operate at loss-giving levels. Hence, the consensus is that the truth is somewhere in the middle. Accordingly, we expect short-term rate levels to accelerate downward post-Lunar New Year, with the big question being the pace of this development.

Regarding long-term rates, these on Asia-Europe are still based on what was negotiated in late Q4 2023; however, they are subject to surcharges such as war risk, operational recovery surcharge, and peak season surcharge. It is currently premature to speculate on when exactly these surcharges will fade; however, considering elevated short-term rate levels, we assess that this will still take some time, considering the significant gap between current short-term rate levels and rates negotiated in Q4 2023.

Airfreight turns red hot

While the early days of January did not signal a tsunami of converted ocean-to-air volumes following the Red Sea crisis, the picture has changed significantly in recent weeks.

Especially the traditional sea-air hubs such as Colombo, Singapore, and Dubai have experienced massive congestion, and even in Bangkok and Doha, a similar situation has been apparent.

Dnata, airport handling operator in Dubai, on Friday, communicated a temporary suspension of inbound volumes, citing that it was being overwhelmed by incoming volumes from Asia: ‘To expedite the recovery process, we are implementing a temporary embargo on import loads of cargo at both Dubai and Dubai World Central airports,’ the Dubai airport authority noted.[6]

In an article published in The Loadstar, Dnata further commented: ‘In recent months, we’ve experienced a significant surge in cargo volumes at our Dubai facilities, particularly in import of general cargo such as fast-moving consumer goods, electronics and fashion accessories’, adding that volumes in January had soared 45% year on year.

As a natural consequence of this recent surge in volumes, rates have also short-term increased +30% during the past weeks.

We do not expect this to be a sustained situation, and our assessment remains that the development in recent weeks more so pertains to a last rush ahead of the Lunar New Year, and not least the effect from Red Sea delays prompting shippers across Europe and USA to utilise airfreight to avoid empty shelves and stock-outs.

With this said, as also seen historically, the rate differential between ocean and airfreight also plays into the situation. In simple terms, when ocean freight rates soar, airfreight becomes relatively cheaper and an overall more cost-sustainable solution.

Considering that the traditional airfreight peak season in November and December also came in stronger than expected, this all points to the conclusion that the cargo airfreight market is steadily improving from a volume perspective following a tough landing after the pandemic.

Our priority continues to be keeping you informed and assisting you in navigating these challenges effectively. Please do not hesitate to contact our team if you have any specific concerns or require assistance with your logistics planning.

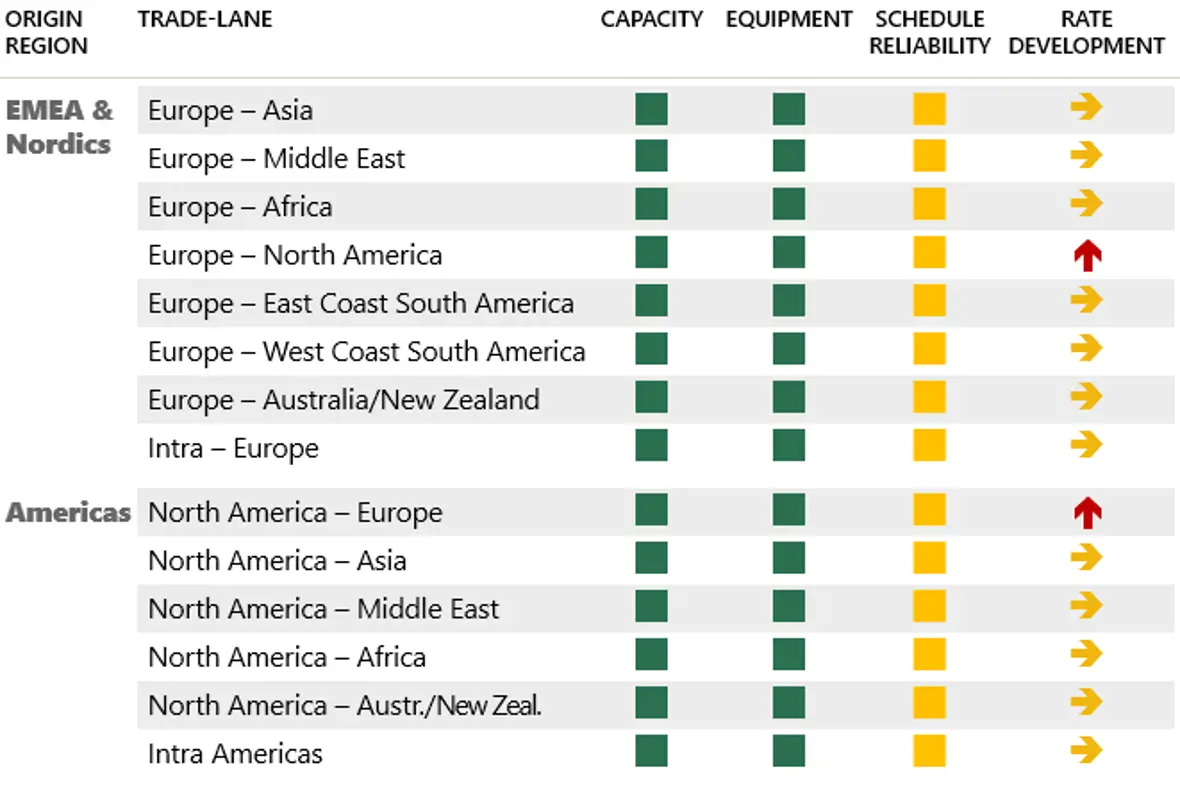

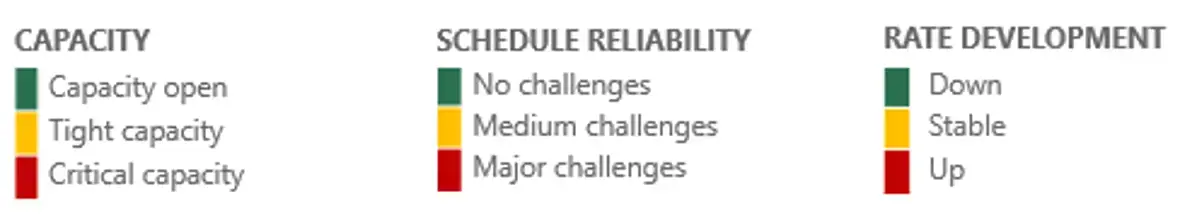

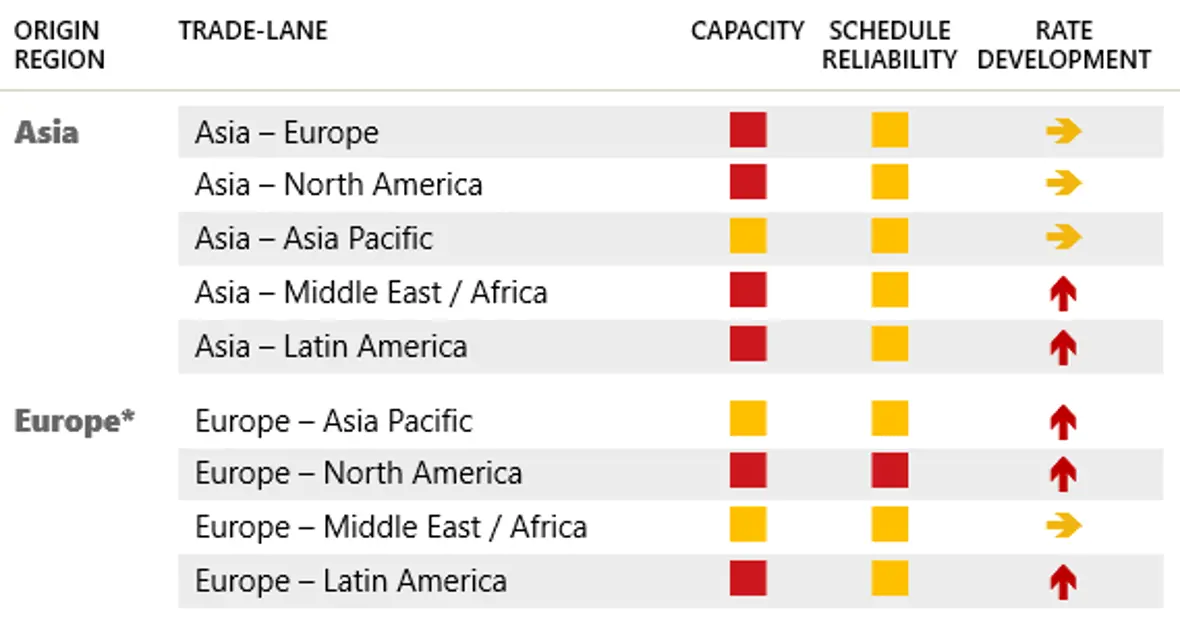

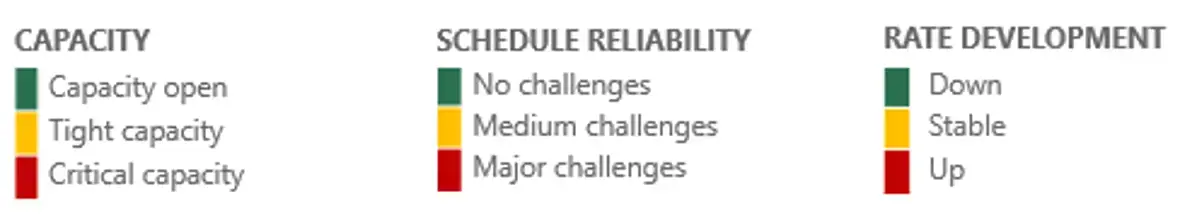

OCEAN FREIGHT

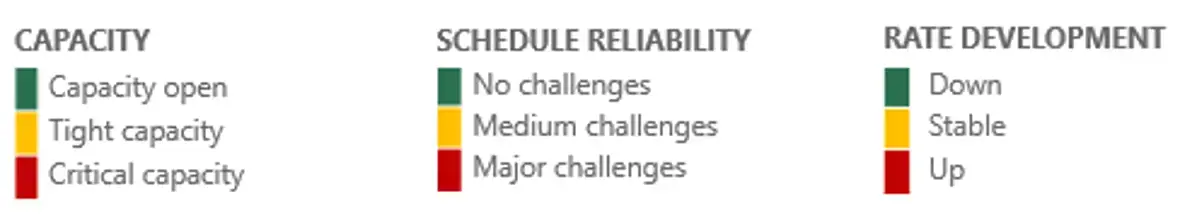

AIR FREIGHT

RAIL FREIGHT

As always, our teams are working around the clock to keep you duly informed both in terms of potential delays and, not least, in terms of alternative solutions.

All the above information is given to the best of our knowledge and is subject to change.

[1] https://en.wikipedia.org/wiki/Bab-el-Mandeb

[2] Far East Loop 4 (FE4) - Route Finder - Hapag-Lloyd

[3] A.P. Moller - Maersk delivered solid 2023 financial results in a difficult environment | Maersk

[4] Maersk weathers stormy Q4 for box services, but fears looming overcapacity - The Loadstar

[5] Maersk weathers stormy Q4 for box services, but fears looming overcapacity - The Loadstar

[6] Surge in air cargo volumes sees flow into Dubai suspended for 48 hours - The Loadstar

On behalf of Scan Global Logistics

Global COO & CCO