On behalf of Scan Global Logistics

Global COO & CCO

Advisory

22 Dec, 2023

A few analysts have noted that some traffic through the Suez Canal is still ongoing, with one example being the 20.000 TEU Ever Goods from Evergreen passing through on the way to Asia. Also, two vessels from CMA CGM passed through the Suez Canal supported by a convoy. However, it is considered that these were merely the last ones prior to all container vessels being re-routed via the Cape of Good Hope.

The below image, courtesy of Lars Jensen, Vespucci Maritime, confirms this, providing a very visual representation of the new reality of re-routed vessels:

This, in turn, means that we can now also conclude that this will not be a short-lived challenge, and the consensus is that, as a minimum, through Q1 2024, this will have a profound effect on the industry.

If one learning stands out from the COVID pandemic, it is that network ripple effects will follow and that incidents are not isolated. Another learning is that once carrier networks are out of sync, then even when “normal” is restored, it will take considerable time before carrier networks are fully functioning again.

Immediate cost impact across all affected trades

In terms of freight rate development, it is no surprise the current events have had an immediate impact. The SCFI index, as of today, Friday 22 December 2023, registered a massive increase on Asia to Europe base ports of almost USD 1.000 per 40´, settling at USD 2.994/40´ vs. USD 2058 just one week ago.

This is the highest level in over a year, and we have to go all the way back to week 44 in 2022 to find a higher level.

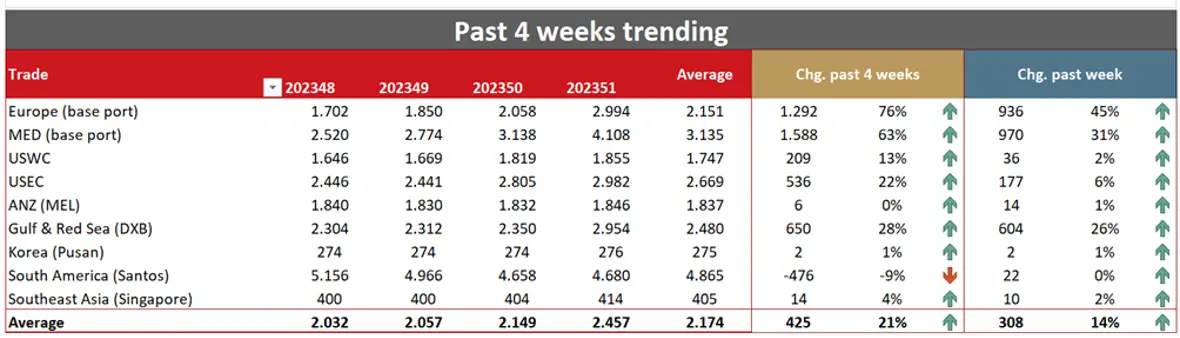

Below is an overview of SCFI rate development covering the past 4 weeks.

It is furthermore expected that SCFI levels will accelerate further in the coming weeks as rates exceeding USD 5.500/40´ are already in the market, bringing back memories of skyrocketing ocean freight rates during the pandemic.

It is also worth noting that while speculation has circled the directly impacted trade lanes, notably Far East Westbound, then surcharges and general rate increases on other trades are likely to come as well.

As one evidence of this, fresh of the press today, MSC announced the introduction of an “Emergency Operations Surcharge” on the Trans-Atlantic trade of USD 2000/40´ for shipments into US, Canada and Mexico from Europe. MSC states that this relates to overall network “operational efficiency” stemming from the re-routing of vessels.

Severe container equipment shortage looms around the corner

It is expected that due to prolonged transit times, equipment container shortage will pose a serious challenge already during January. Empty container re-positioning is equally impacted by these delays, and a headline in The Loadstar summed it up quite well, stating: “Empty boxes will be stuck in all the wrong place for new year peak”[1] serving a painful reminder that the current challenges come, at the exact time that marks the traditional peak season for cargo ex Asia ahead of Lunar New Year celebrations.

This view is echoed in our current and ongoing dialogues with our carrier partners. Equipment shortage in key shipping ports will be a serious challenge in the very near future and especially special equipment will be heavily impacted. It is important to note this will affect both ports in Asia and Europe, and accordingly, it is expected that there will be a severe equipment shortage in Europe within the coming 6-8 weeks.

Lars Jensen, CEO of Vespucci Maritime, agreed and warned: “We might have enough containers, but they might not be in the right geographical locations. Vessels bringing in empty containers needed for peak season in China will end up stuck in other places.”[2]

Similar to the surcharges implemented on the Trans-Atlantic trade by MSC, the first reports on the reduction of demurrage/detention free-time days have also emerged. This comes in an attempt from carriers to pre-mitigate expected container availability challenges. It is, however, premature to speculate on the full magnitude of this.

Voyage blankings back in full force!

On top of extended lead times of up to 14 days from Asia to Europe, we have already now seen significant increases in announced voyage “blankings”. As communicated in our previous advisory, more vessels per round trip from Asia-Europe-Asia are needed to maintain the weekly schedule. This logically means that in the short term, there are simply not enough vessels to cater for this.

We are in the process of establishing a full overview of announced voyage blankings, and this will be communicated without delay when available.

What we can conclude for now

If anyone had a faint hope that this would be a short-lived issue, then already now, this hope has been squashed. It is clear that the impact will be immense both from a perspective of delayed cargo and a significant cost impact.

We encourage all our customers to explore other options in a collaborative manner with our customer service teams, be it in the form of airfreight, sea-air or rail freight, as well as alternate ocean routings.

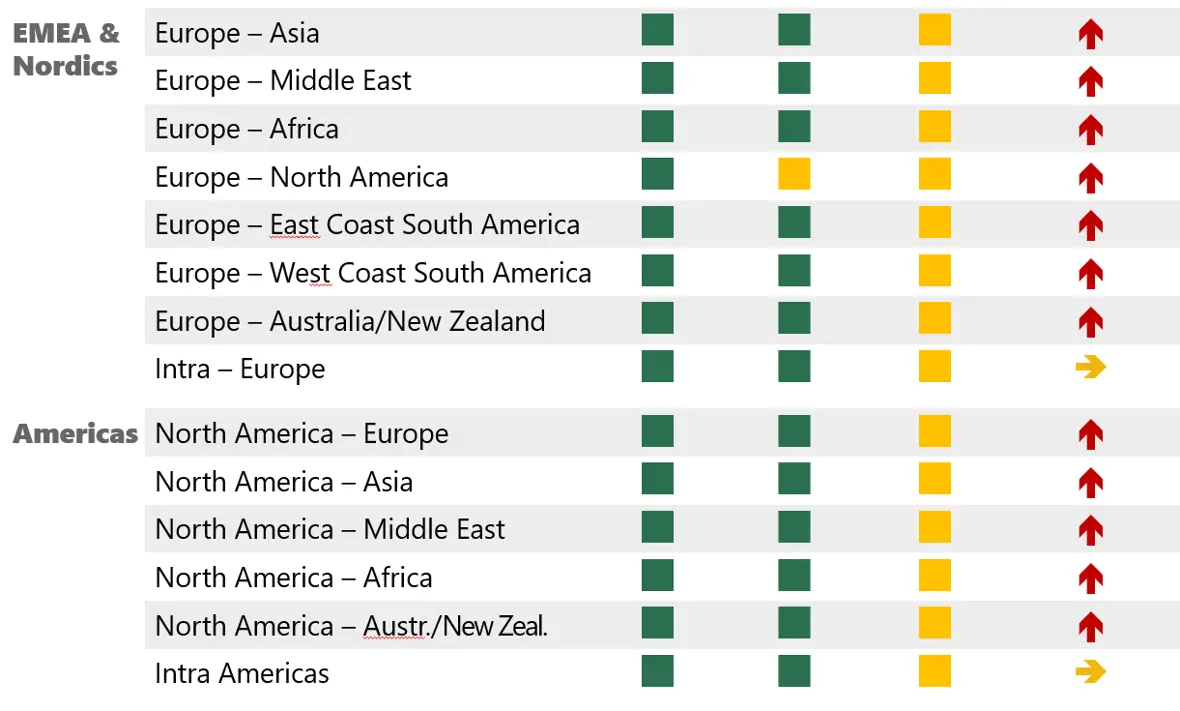

Below you will find our latest trade development overview as of 22 December 2023.

The situation remains fluid, and our teams are naturally working tirelessly to keep any impact on your business at a minimum.

We will continue to keep you updated as the situation develops further. All information provided is given to the best of our knowledge and is subject to change.

[1] https://theloadstar.com/empty-boxes-will-be-stuck-in-all-the-wrong-places-for-new-year-peak/

[2] https://www.linkedin.com/feed/update/urn:li:activity:7143875123186503680/#

On behalf of Scan Global Logistics

Global COO & CCO