CBAM is complex. Staying compliant doesn't have to be.

If you’re importing carbon-intensive goods into the EU, then you've most likely felt the pressure of the EU's Carbon Border Adjustment Mechanism (CBAM).

We know that many EU importers struggle to understand the financial impact of CBAM on their business, secure accurate emissions data, engage suppliers, and keep pace with the evolving requirements.

That's why we're here to uncomplicate it for you.

From data to deadlines, our dedicated CBAM specialists help you stay compliant, avoid disruption, and turn CBAM into a competitive advantage - no matter where you operate.

Leading businesses trust us

From manufacturing giants to innovative brands, our customers rely on us to navigate the complexities of CBAM with confidence. We automate, guide, and tailor carbon compliance—turning regulation into real-time readiness.

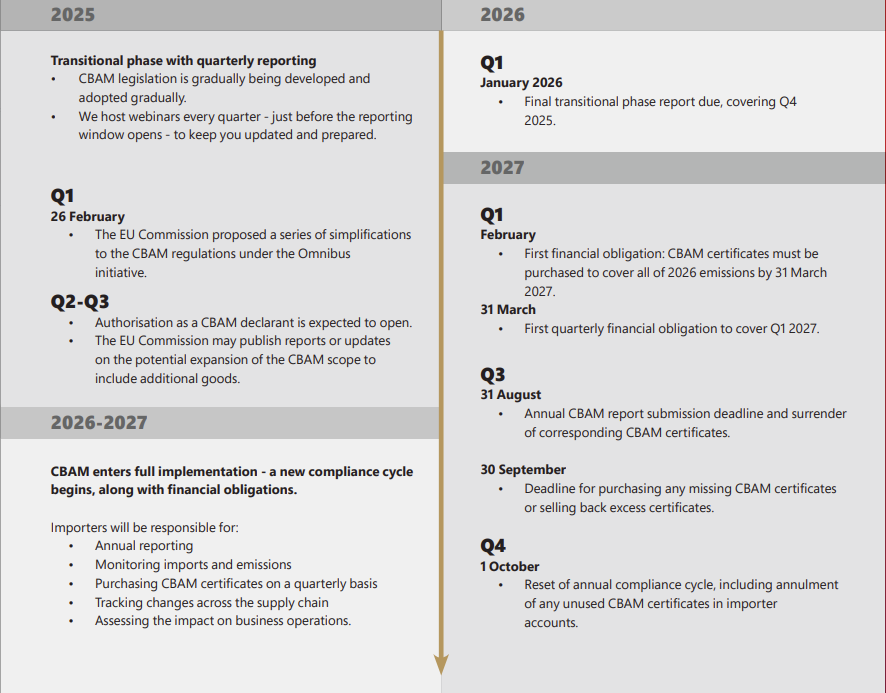

Key dates and milestones for CBAM importers

What our partners are saying

FAQ - What importers need to know

CBAM (Carbon Border Adjustment Mechanism) is an EU regulation that imposes a carbon price on certain imported goods to prevent carbon leakage and align climate costs between EU and non-EU producers.

If you're importing goods like steel, aluminium, cement, fertilisers, electricity, and hydrogen into the EU, CBAM applies to you.

You’ll need to submit quarterly reports on the GHG emissions embedded in your imported goods. This includes direct and, in some cases, indirect emissions from production. The first report was due in January 2024, with reporting continuing until the full mechanism takes effect in 2026.

Yes. If you miss a report or submit incorrect data, you could face penalties between EUR 10 and EUR 50 for every tonne of unreported emissions. On top of that, non-compliance may lead to customs delays, so it's worth getting it right from the start.

It starts with transparency. Your suppliers need to understand CBAM requirements and provide verified emissions data. We help you identify gaps, request the right information, and build a practical process that fits into your current import routines.

Absolutely. CBAM support is part of our advisory services, helping you navigate new requirements with tailored guidance, practical solutions, and access to tools like data collection and reporting when needed. You get a dedicated specialist who understands your business and moves at your speed to keep your supply chain moving.

Purchase CBAM certificates for your embedded emissions

Purchase CBAM certificates for your embedded emissions