On behalf of Scan Global Logistics

Global COO & CCO

Market update

20 Dec, 2023

It is now clear that regardless of mitigating measures, the short-term effects will be substantial both in relation to the potential delay of cargo, as well as there will be a significant cost impact.

Vincent Clerc, CEO of Maersk, explains: “One of the first incidents that came to mind was the Ever Given which was stranded in the Suez Canal during Covid. At that time the issue was resolved within days and normal transit times reinstated rather quickly. In this case the outlook is that it will take longer”. [1]

A US-led military coalition (Operation Prosperity Guardian) has been formed with other allied nations. However, echoing comments from Vincent Clerc, there is a general consensus that it will take some time before security for vessels passing through the Red Sea is restored.

Most container vessels diverted, leading to longer transit times

Container carriers have accordingly started to re-route vessels around the Cape of Good Hope. Hapag Lloyd has re-routed more than 25 vessels already, and the equivalent number for Maersk being 20 vessels. In other cases, vessels have been instructed to pause their voyage and seek safe harbour until further notice.

Below illustration, published by Lars Jensen, CEO at Vespucci Maritime, accurately shows the impact that the ongoing re-routing has:

Source: Lars Jensen, CEO Vespucci, LinkedIn:

Lars Jensen comments: 'A snapshot of all container vessels with a capacity of 16.000 TEU or more. It is very clear that all vessels coming from Asia are now diverting to take the round-Africa route.

Likewise, the Mediterranean is almost entirely a 1-way street of vessels heading for the Straits of Gibraltar. Somewhat akin to seeing a bathtub being drained.

A few remain stuck in the Red Sea with a choice between running the missile gauntlet by the Houthis or pay, likely, more than ½ million USD to get through the Suez Canal to get back to the Med.'

First and foremost, the current situation will impact the Far East and Sub-Continent to Europe, Europe to Far East and Sub-continent trades. The Asia to the US East Coast will also be partly affected, given that some carriers have utilised Suez Canal to service this trade due to Panama Canal drought issues.

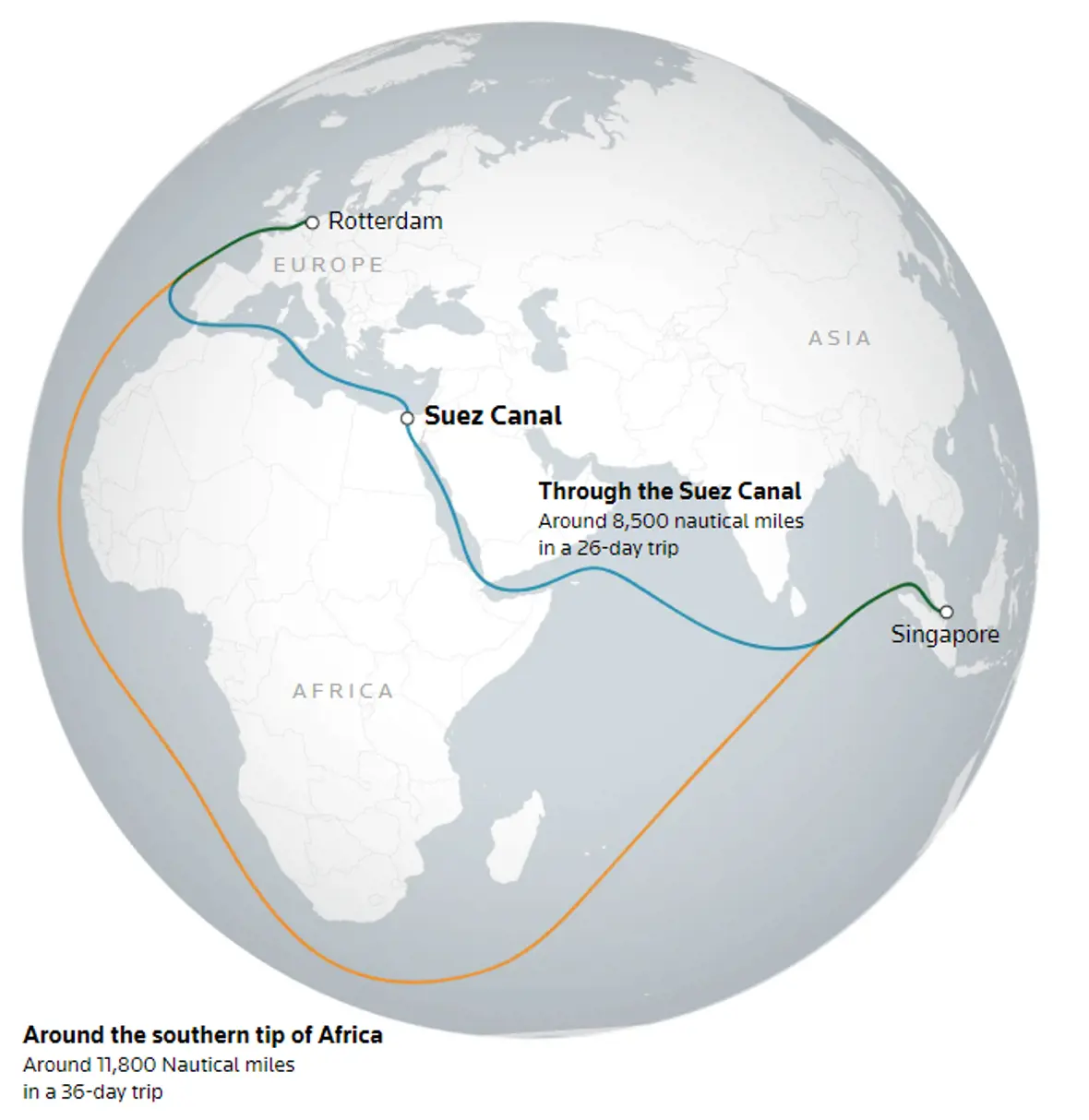

The estimated delay stemming from re-routing via the southern tip of Africa is approximately 10-14 days, as shown below. For cargo already in transit and trapped in the Red Sea, the delays can extend beyond this.

We are continuously working on creating a full overview of re-routed vessels and thereby also impacted containers. Our operations teams will inform you of all potential delays, and at the same time, we encourage you to contact your regular contact person(s) at Scan Global Logistics if you have any queries related to this situation.

Short-term impact includes the following:

And, in another potentially worrying development for shippers, French carrier CMA CGM said that, due to the situation in the Red Sea, it was invoking a force majeure clause in its bill of lading, relieving it of the liability of non-performance. [2]

We will seek to inform you separately and without delay in cases of additional cost while we, at the same time, will do our utmost to keep the same at a minimum.

Other mitigating measures:

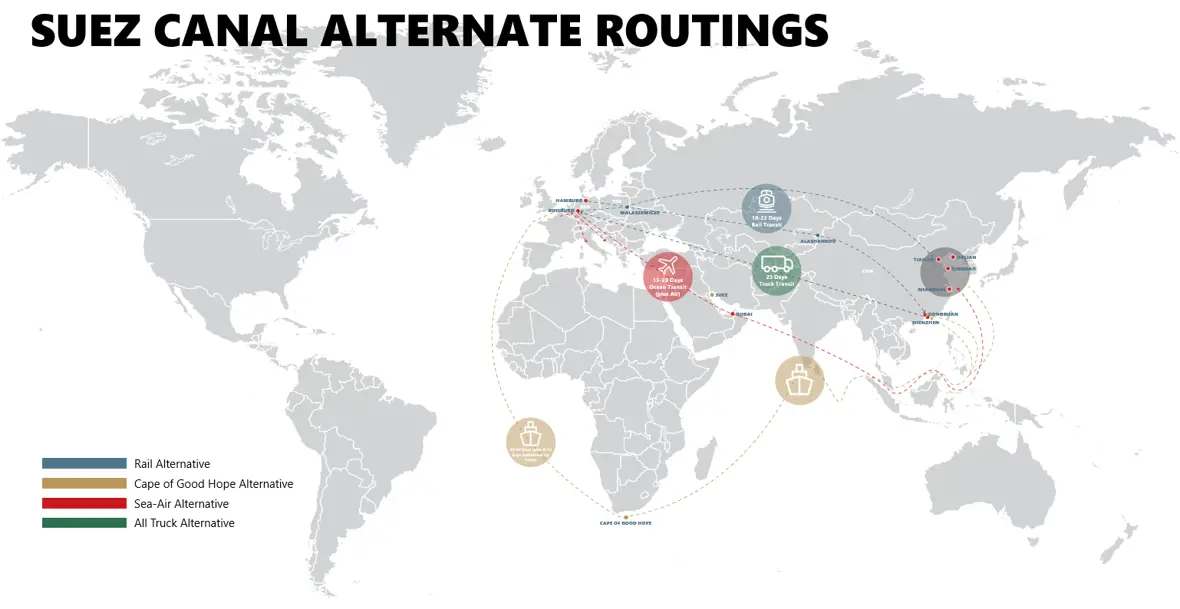

Below is an overview of alternate solutions, which we encourage you to explore in collaboration with our customer service teams:

The current situation is fluid and is evolving by the hour, and accordingly, we appreciate your continued support as we work closely with our carrier partners to minimise the potential impact on your shipments.

As always, we will seek to provide alternative solutions that will enable us jointly to allow for minimal disruption to your supply chain.

Lastly, we recommend that you subscribe to our newsletter here to ensure you receive relevant information immediately. All information is given to the best of our knowledge and is subject to change.

[1] https://shippingwatch.dk/Rederier/article16700877.ece:

[2] https://theloadstar.com/carriers-roll-out-peak-season-surcharges-as-capacity-crunch-looms/

On behalf of Scan Global Logistics

Global COO & CCO