Advisory

Ocean Freight facing a new storm of volatility

18 Dec, 2023

While some disruption due to Panama Canal drought has plagued the industry in recent months, the latest development of missile attacks on vessels passing through the BaB al-Mandab strait in the Red Sea holds the potential of a significantly larger disruption for the industry as a whole.

Red Sea passage issues triggers a new Suez Canal crisis

In recent weeks, around 10 commercial vessels have been attacked, with Maersk Gibraltar as the latest case. The attacks by the Houthi Milita off the coast of Yemen have prompted container carriers to call for political action leading both USA and UK to increase their military presence in the strait. The Houthi militia in return is insisting attacks will continue until Israel ceases it´s military operations in the Gaza strip.

Nonetheless, all leading container carriers have temporarily suspended services through the Red Sea and thus also the Suez Canal with this particular area marking the entrance to the Suez Canal.

The only viable alternative is passage around Africa via Cape of Good Hope, however this is both a costly alternative, as well as it has a significant impact on total transit times. According to experts this will add approximately 4.000 nautical miles to each vessels voyage, equivalent to 7.300 kilometers which in turn means adds 10 days to each voyage.

During the weekend MSC as the first carrier announced that it had re-routed some of their vessels to go via the Cape of Good Hope. Other carriers are yet to communicate a similar action with Maersk, Hapag Lloyd and CMA-CGM all assessing the situation before making a decision.

Volatility likely to lead to instant rate increases

In addition to shipment delays it is also likely that shippers will be faced with increased rate levels as a result of the latest development. According to Xeneta Chief Analyst, Peter Sand then ‘depending on the scale and duration, we could see ocean freight prices increase by up to 100 %’ indicating that we could be faced with a milder version of the supply chain crisis seen during the worst of the pandemic.

The coming days and weeks will give a more concrete sign on the severity of this situation, however as seen in recent years incidents are not isolated and will have ripple effects throughout the industry impacting scheduled services as well impacting pricing trends.

We are closely monitoring the situation and will keep you informed when there are further developments.

Panama Canal status

The decreased water level in the Panama Canal region has resulted in severe drought conditions, forcing authorities to limit the number of daily vessel passages. The number is decreasing month by month; in October, there were 32, and in November, the number was reduced to 24. Due to this situation, various carriers are implementing surcharges and rate increases.

Blank sailings persist across all major east-west trade lanes, leading to space constraints. This trend is anticipated to continue in the coming period and overall significant volatility is to be expected.

Blank sailings and rate development

During last 4 weeks, spot rates on the major east-west trades increased averagely by 24%, according to SCFI. The most notable increases are on the Asia-Europe by 32% and Asia-MED by 33%.

Main reason is the pre-rush of cargo because of Lunar New Year holidays coupled with a major blank sailing program announced by the carriers in the upcoming 12 weeks. With the latest development in the Red Sea this trend is expected to accelerate with carriers expected to seize the opportunity to implement rate increases in what is the peak of 2024 contract season.

Below is an overview of latest announced black sailings:

- 10 Blank Sailings on the Asia North Europe trade

- 11 Blank Sailings on the Asia Mediterranean trade

- 21 Blank Sailings on Asia-to-US East Coast

- 36 Blank Sailings on Asia-to-US West Coast

EU’s ETS regulations will take effect on 1 January 2024

The new environmental regulation ETS will take effect on 1 January 2024. It is part of the EU’s ambition to become carbon neutral by 2050 and meet the first goal of a 50 % reduction in 2030. This new carbon tax will impact all transport to, from and within the European Economic Area (EEA). If you want to know more, please read our latest update here.

A potential solution to address the environmental surcharge involves exploring sustainable logistics solutions, such as biofuel, which significantly reduces CO2 emissions. Further information on available options can be found here.

Pro-active measures required to mitigate current volatility

Navigating through the current volatility is crucial, and meticulous pro-active planning will be essential in the upcoming period. We recommend increased focus on urgent shipments and our teams around the world will be looking into all alternative routings and transport mode options.

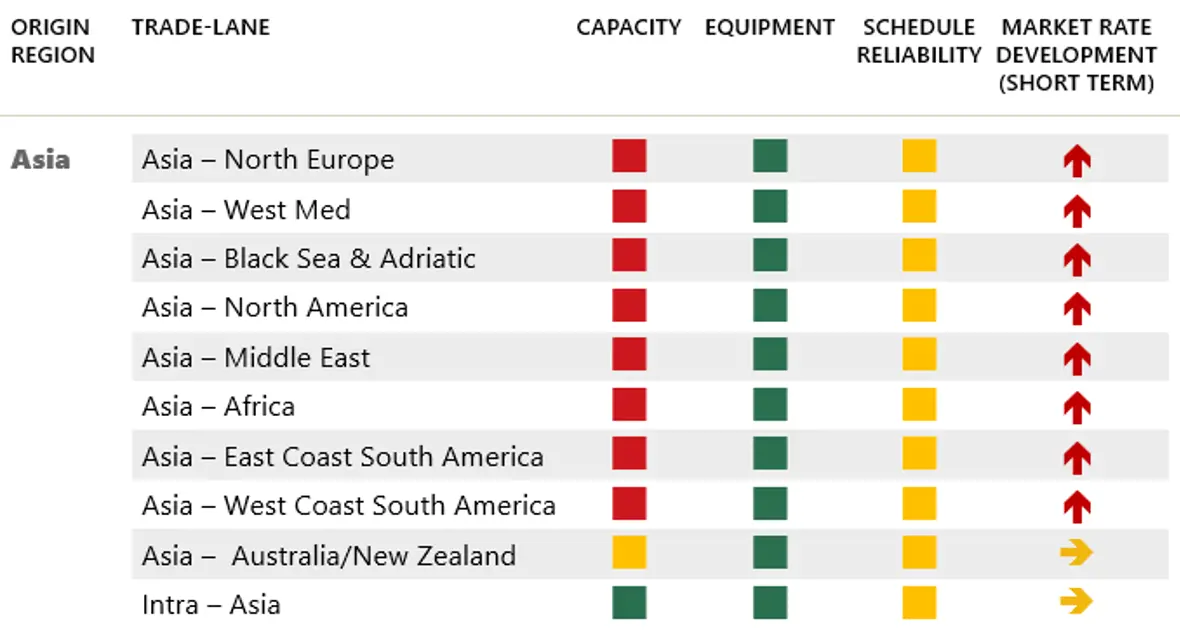

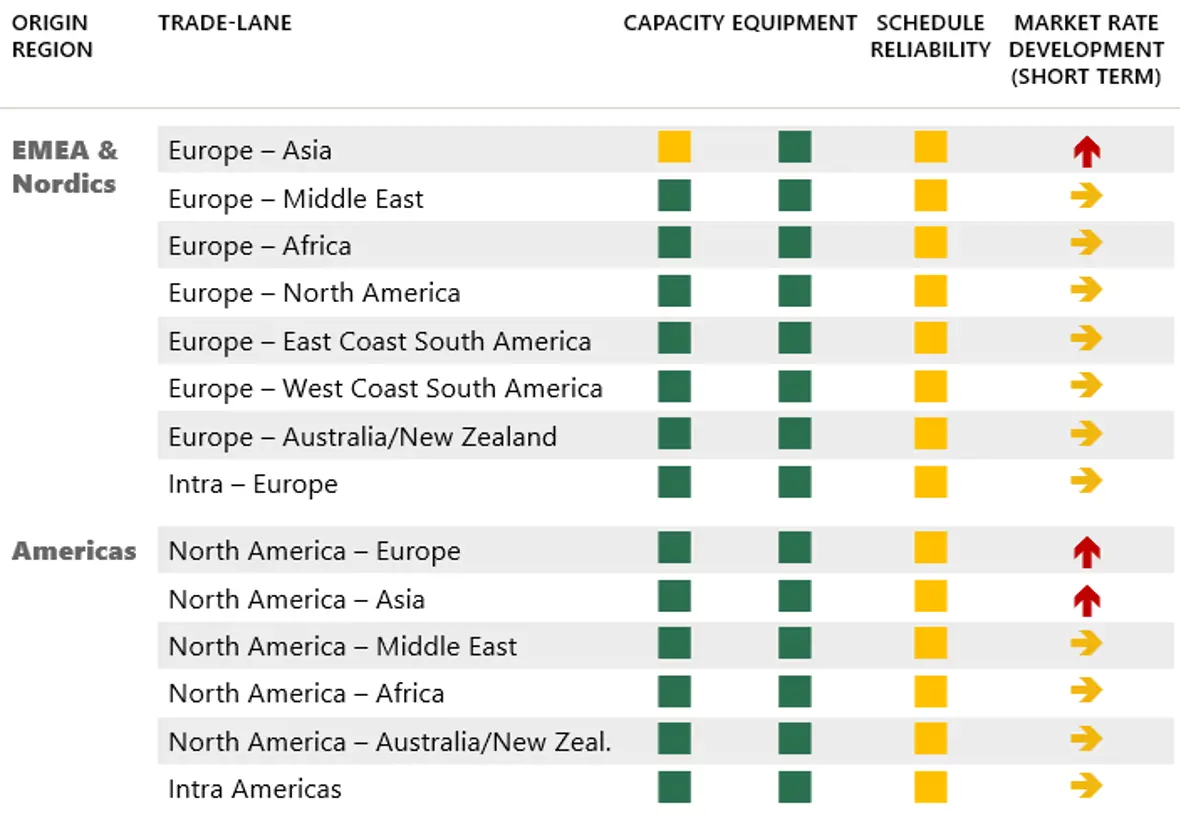

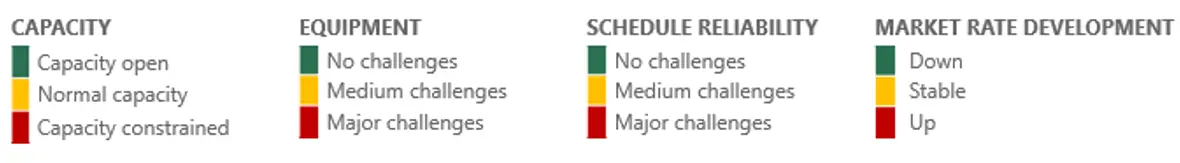

Below you will find our latest trade development overview as of week 51