Advisory

Airfreight – the pressure is on

18 Dec, 2023

Throughout 2023, the global load factor has remained as low as approximately 60%, but went up significantly during Q4 accelerating especially in December. In short, higher volumes than expected and reduced capacity following winter schedule changes led to this unexpected situation. The situation was influenced as well by seasonal weather impact in Asia. Specifically in India, the situation been critical with more than 650 flights cancelled at the beginning of December due to heavy rains in Chennai and Cyclone Michaung in Andhra Pradesh.

We do expect the worst volatility to have passed, however, some pressure on Asia schedules in the coming weeks is expected as backlogs are being cleared.

What does the Crystal Bowl predict for the coming period

We expect the worst pressure to subside in the first half of January, followed by an upturn (to/from Asia) from mid-January as we edge closer to Lunar New Year.

On the American market, there are indications that the summer schedule will begin six weeks earlier than usual for at least one carrier. This is a new situation, indicating shifts in demand patterns and we will follow this development closely.

Moving into Q2 2024, the airfreight market is expected to witness an increase in capacity due to winter-to-summer flight schedule changes. In April and May, we could see a reduction in output from the EU due to the impact of various holidays, leading to a further decrease in rates. And when we look even further ahead to second half of 2024, we expect the market to pick up again as of the end of Q3.

It is, however, important to take note that the market's outlook is influenced by some recent uncertainty surrounding oil price development and the overall unstable geo-political situation, which has the potential to impact the entire airfreight industry.

First of those “unstable global situations” are the difficult scenarios evolving around the Red Sea/Suez-canal and Panama-canal-scenarios. Especially the Suez-canal-situation will lead to more demand for alternative transport modes from Asia to Europe sustaining airfreight demand as a result. If this continues to hold on during January, we will see more pressure on capacity and rate increases to follow accordingly.

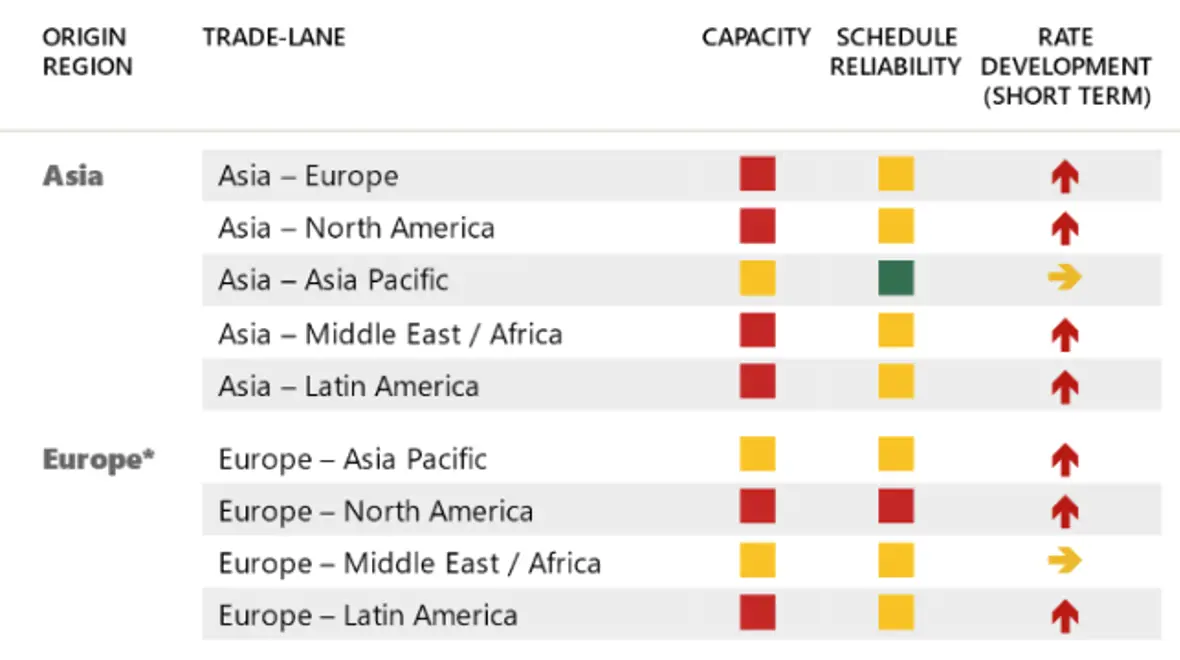

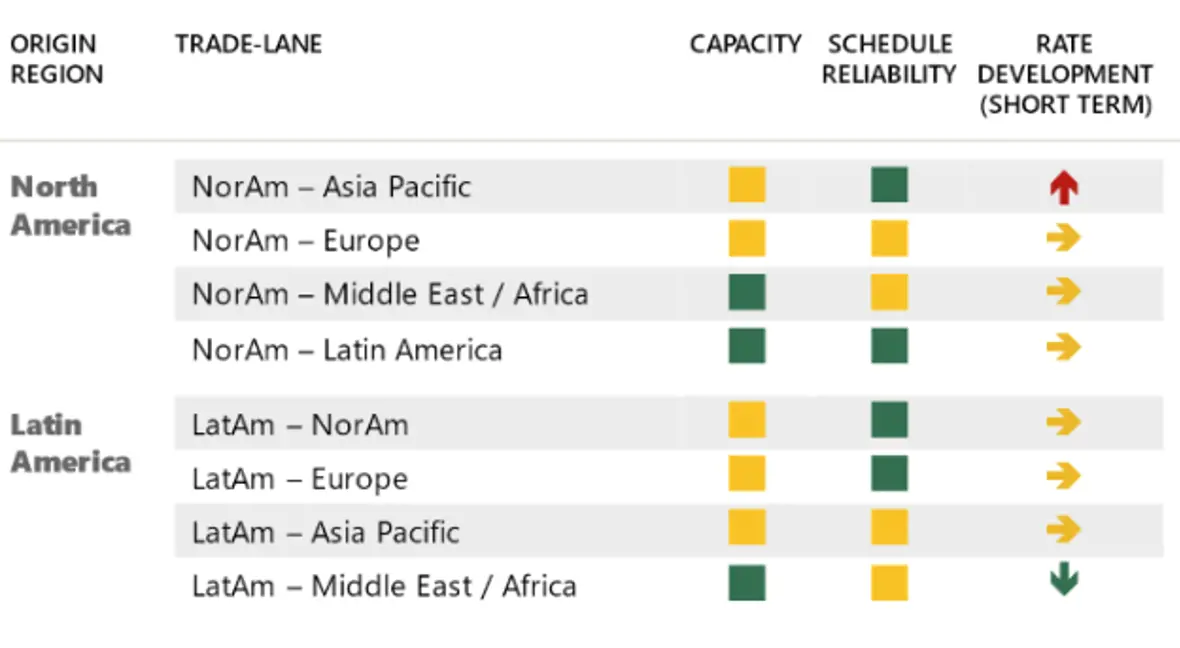

Below you will find our latest trade lane development overview as of week 51: